Professional illustration about Bitcoin

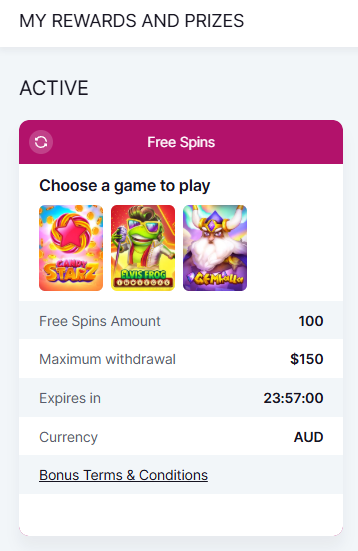

Bitcoin Price Trends 2025

Bitcoin Price Trends 2025: What to Expect in the Crypto Market

The Bitcoin price in 2025 is shaping up to be one of the most talked-about topics in the cryptocurrency space, driven by a mix of macroeconomic factors, institutional adoption, and technological advancements. After the 2024 Bitcoin halving, which reduced the block reward to 3.125 BTC, the supply shock is expected to play a significant role in pushing prices higher. Historically, Bitcoin has seen substantial rallies 12-18 months post-halving, and 2025 could follow this trend, especially with increasing demand from ETFs like those offered by BlackRock and Fidelity. The approval of spot Bitcoin ETFs in early 2024 marked a turning point, bringing institutional capital into the market and reducing volatility. Analysts predict that Bitcoin could reach new all-time highs, with some projections suggesting a price range between $100,000 and $150,000, depending on adoption rates and macroeconomic conditions.

One major factor influencing Bitcoin’s price in 2025 is institutional interest. Companies like MicroStrategy continue to accumulate BTC as a treasury reserve asset, while traditional finance giants such as Grayscale and Coinbase expand their crypto offerings. The growing integration of blockchain technology into mainstream finance, including decentralized finance (DeFi) applications, adds another layer of demand. Additionally, the Lightning Network’s scalability improvements are making Bitcoin more practical for everyday transactions, further boosting its utility. However, regulatory developments, particularly around crypto exchanges like Binance, could introduce short-term volatility.

From a technical perspective, Bitcoin’s price action in 2025 will likely hinge on trading volume and market capitalization trends. The crypto market as a whole is becoming more mature, with Ethereum and other altcoins often moving in correlation with BTC. Traders should watch key support and resistance levels on the Bitcoin chart, as well as macroeconomic indicators like inflation and interest rates, which have historically impacted crypto markets. Meanwhile, Bitcoin mining profitability remains a critical factor—miners’ selling pressure could influence short-term price movements, especially if energy costs rise.

For long-term investors, the fundamentals remain strong. Satoshi Nakamoto’s vision of a decentralized currency is gaining traction, and the Bitcoin whitepaper continues to serve as the foundation for innovation. Whether you’re trading on Binance, holding through a Grayscale trust, or using Coinbase for custody, understanding these trends will be crucial in navigating the 2025 market. Keep an eye on Bitcoin ETFs, institutional inflows, and technological upgrades—these will be the key drivers of price action in the coming year.

Professional illustration about Blockchain

How Bitcoin Mining Works

How Bitcoin Mining Works

At its core, Bitcoin mining is the process of validating transactions and adding them to the blockchain, the decentralized ledger that powers the entire cryptocurrency ecosystem. Miners compete to solve complex mathematical puzzles using high-powered computers, and the first to succeed earns the right to add a new block of transactions to the chain. This not only secures the network but also releases new Bitcoin into circulation as a reward—a mechanism outlined in the original Bitcoin Whitepaper by Satoshi Nakamoto.

The mining process relies on Proof of Work (PoW), a consensus algorithm that ensures trustless verification. Miners bundle pending transactions from the Bitcoin mempool into a block, then use specialized hardware (like ASICs) to hash the block’s data until they find a solution that meets the network’s difficulty target. This difficulty adjusts every 2,016 blocks (roughly two weeks) to maintain a consistent block time of 10 minutes, regardless of fluctuations in global mining power.

Key Components of Bitcoin Mining:

- Hardware: Modern miners use Application-Specific Integrated Circuits (ASICs), which are far more efficient than CPUs or GPUs. Companies like MicroStrategy and Grayscale have invested heavily in mining infrastructure, recognizing its long-term value.

- Energy Consumption: Mining is energy-intensive, often drawing criticism. However, many operations now leverage renewable energy, with some even repurposing excess energy from oil fields or solar farms.

- Mining Pools: Solo mining is nearly impossible today due to high competition. Instead, miners join pools (like those offered by Binance or Fidelity) to combine computational power and share rewards proportionally.

- Block Rewards: Miners currently earn 3.125 BTC per block (post-Bitcoin Halving in 2024), plus transaction fees. This reward halves every 210,000 blocks (approximately four years), a deflationary feature hardcoded into Bitcoin’s protocol.

The Role of Mining in Bitcoin’s Economy

Mining isn’t just about creating new coins; it’s the backbone of Bitcoin’s security. Each block added to the blockchain makes past transactions immutable, preventing double-spending. The decentralized nature of mining—distributed across thousands of nodes worldwide—ensures no single entity (not even BlackRock or Coinbase) can control the network.

Challenges and Innovations

With rising Bitcoin prices and institutional interest (evidenced by spot Bitcoin ETFs), mining has become a high-stakes industry. However, profitability depends on factors like electricity costs, hardware efficiency, and market capitalization trends. Innovations like the Lightning Network aim to reduce the load on the main chain by processing smaller transactions off-chain, indirectly benefiting miners by prioritizing high-fee transactions.

Real-World Example:

In 2025, a mining farm in Texas might use stranded natural gas to power ASICs, selling excess energy back to the grid during peak demand. This showcases how mining can align with broader energy markets while supporting decentralized finance.

Why Mining Matters for Investors

For traders monitoring the Bitcoin chart, mining activity offers clues about network health. A rising hash rate signals strong security, while shifts in trading volume or miner sell-offs can indicate market sentiment. Institutions like Grayscale and MicroStrategy often analyze these metrics to inform their crypto trading strategies.

In summary, Bitcoin mining is a dynamic interplay of technology, economics, and game theory—one that continues to evolve alongside the crypto market. Whether you’re a miner, investor, or simply curious about Ethereum’s rival, understanding this process is crucial to grasping Bitcoin’s decentralized revolution.

Professional illustration about Cryptocurrency

Bitcoin Wallet Security Tips

Securing your Bitcoin wallet is non-negotiable in today’s crypto landscape, where threats like phishing, malware, and exchange hacks (looking at you, Binance and Coinbase breaches) are rampant. First, never store large amounts of Bitcoin on exchanges—despite their convenience, they’re prime targets. Instead, use hardware wallets (like Ledger or Trezor) for cold storage, which keeps your private keys offline and immune to remote attacks. For active traders, a multi-signature wallet adds an extra layer of security by requiring multiple approvals for transactions, reducing single-point failures.

Next, enable two-factor authentication (2FA) everywhere—but avoid SMS-based 2FA, which is vulnerable to SIM swaps. Use authenticator apps like Google Authenticator or hardware keys. Also, backup your seed phrase meticulously: write it on steel (yes, fireproof and waterproof), store it in multiple secure locations, and never digitize it (no cloud storage or photos). Remember, losing your seed phrase means losing access to your Bitcoin forever—just ask the folks who mined early and forgot their keys.

Stay vigilant against scams. Fake wallet apps, fraudulent Bitcoin ETF announcements (cough, Grayscale, BlackRock), and fake Lightning Network nodes are everywhere. Always verify URLs, double-check wallet addresses before sending, and avoid clicking shady links promising "free Bitcoin." For advanced users, consider decentralized finance (DeFi) alternatives like self-custody wallets (e.g., Electrum), but beware of smart contract risks—Ethereum’s ecosystem is especially prone to exploits.

Lastly, keep your software updated. Wallet vulnerabilities (even in Bitcoin Core) get patched regularly, and outdated apps are low-hanging fruit for hackers. Monitor Bitcoin transaction mempools for unusual activity, and if you’re into Bitcoin mining, secure your node with a firewall. Pro tip: Diversify storage—split holdings between hot wallets (small amounts for daily use) and cold storage (long-term HODL). Because in crypto, your keys, your coins—Satoshi Nakamoto didn’t design blockchain for reckless custody.

Professional illustration about MicroStrategy

Bitcoin vs. Altcoins 2025

Bitcoin vs. Altcoins 2025: The Battle for Dominance in the Crypto Market

As we navigate 2025, the rivalry between Bitcoin and altcoins continues to shape the cryptocurrency landscape. While Bitcoin remains the undisputed king with its market capitalization dwarfing competitors, Ethereum, Binance Coin, and other altcoins are aggressively innovating to carve out their niches. The blockchain ecosystem has evolved dramatically, with Bitcoin solidifying its role as digital gold—thanks to institutional adoption by giants like MicroStrategy, Grayscale, BlackRock, and Fidelity—while altcoins push the boundaries of decentralized finance (DeFi) and smart contracts.

One of the most significant factors separating Bitcoin from altcoins is its scarcity, reinforced by the Bitcoin halving events. The 2024 halving reduced the mining reward to 3.125 BTC, further tightening supply amid growing demand. This deflationary mechanism, outlined in the Bitcoin whitepaper by Satoshi Nakamoto, contrasts sharply with many altcoins, which often have inflationary or flexible tokenomics. For example, Ethereum’s shift to proof-of-stake (PoS) has altered its supply dynamics, while newer altcoins experiment with burning mechanisms to mimic Bitcoin’s scarcity.

Trading volume and liquidity also highlight key differences. Bitcoin dominates crypto exchanges like Coinbase and Binance, where its Bitcoin price stability attracts long-term investors. Meanwhile, altcoins frequently experience higher volatility, offering traders short-term opportunities but also greater risk. The approval of Bitcoin ETFs in 2024 further cemented Bitcoin’s institutional appeal, whereas altcoin ETFs remain rare, reflecting regulatory hesitancy around lesser-known projects.

Technologically, Bitcoin prioritizes security and decentralization over speed, relying on the Lightning Network for scalable transactions. In contrast, altcoins like Ethereum and Solana focus on scalability and programmability, enabling complex DeFi applications and NFTs. This divergence creates a clear trade-off: Bitcoin is the go-to for store-of-value purposes, while altcoins cater to developers and users seeking advanced blockchain functionality.

From an investment perspective, Bitcoin mining remains a high-barrier-to-entry industry dominated by specialized firms, whereas altcoin mining (or staking) is often more accessible to retail participants. The crypto market in 2025 reflects this dichotomy—Bitcoin is the cornerstone of portfolios, while altcoins serve as speculative bets on emerging trends.

Ultimately, the choice between Bitcoin and altcoins depends on your goals. If you seek stability and institutional-grade adoption, Bitcoin is unmatched. But if you’re willing to embrace risk for potentially higher rewards, altcoins offer exposure to the cutting edge of cryptocurrency innovation. Keep an eye on market cap trends, trading volume, and regulatory developments to stay ahead in this dynamic space.

Professional illustration about Nakamoto

Bitcoin ETF Latest Updates

Bitcoin ETF Latest Updates

The Bitcoin ETF landscape has evolved dramatically in 2025, with major financial institutions like BlackRock, Fidelity, and Grayscale solidifying their positions in the crypto market. The approval and performance of these ETFs have significantly influenced Bitcoin price movements, attracting both institutional and retail investors. For instance, BlackRock’s iShares Bitcoin Trust (IBIT) continues to dominate trading volume, while Fidelity’s Wise Origin Bitcoin Fund has seen steady inflows, reflecting growing confidence in cryptocurrency as a mainstream asset class.

One of the most notable developments this year is the surge in market capitalization for Bitcoin ETFs, which now collectively hold over $50 billion in assets under management (AUM). This growth is partly driven by the Bitcoin halving event in 2024, which reduced the supply of new Bitcoin mining rewards and heightened scarcity. Analysts attribute the sustained demand to ETFs providing a regulated gateway for exposure to Bitcoin without the complexities of direct ownership, such as securing wallets or navigating crypto exchanges like Coinbase or Binance.

The Lightning Network has also played a role in ETF adoption, as its scalability improvements address long-standing concerns about Bitcoin transaction speeds and costs. Meanwhile, companies like MicroStrategy continue to double down on Bitcoin acquisitions, further validating its store-of-value narrative. Interestingly, the resurgence of interest in the Bitcoin whitepaper—authored by the enigmatic Satoshi Nakamoto—has coincided with ETF mania, as investors revisit the foundational principles of blockchain technology.

For traders monitoring the Bitcoin chart, ETF flows have become a key metric. Days with high trading volume often correlate with price spikes, particularly when institutions like Grayscale adjust their holdings. However, critics warn of potential volatility, as ETF liquidity depends heavily on crypto market sentiment. For example, a sudden regulatory crackdown or a shift in decentralized finance (DeFi) trends could impact ETF stability.

Looking ahead, the integration of Ethereum-based smart contracts into Bitcoin ETF structures is gaining traction, offering programmable features like automated rebalancing. This innovation could further bridge the gap between traditional finance and the crypto trading ecosystem. As the SEC evaluates new ETF proposals, the focus remains on transparency and custodial safeguards—factors that will shape the next phase of Bitcoin ETF growth.

Professional illustration about Ethereum

Bitcoin Halving Impact 2025

The Bitcoin halving in 2025 is one of the most anticipated events in the cryptocurrency world, and its impact on the Bitcoin price, mining ecosystem, and broader crypto market cannot be overstated. Occurring roughly every four years, the halving cuts the block reward for Bitcoin miners in half, reducing the rate at which new Bitcoin enters circulation. This built-in scarcity mechanism, first outlined in the Bitcoin whitepaper by Satoshi Nakamoto, has historically triggered significant price rallies. In 2025, the reward will drop from 3.125 BTC to 1.5625 BTC per block, further tightening supply amid growing demand from institutional players like BlackRock, Fidelity, and Grayscale, whose Bitcoin ETF approvals have already reshaped the market.

One of the immediate effects of the 2025 halving will be on Bitcoin mining profitability. With rewards slashed, inefficient miners may be forced to shut down operations unless the Bitcoin price rises sufficiently to offset the reduced income. This could lead to consolidation in the mining industry, with larger players like MicroStrategy—which has aggressively accumulated BTC—potentially gaining more influence. Meanwhile, innovations like the Lightning Network could see increased adoption as transaction fees may rise due to reduced block subsidies, pushing users toward layer-2 solutions for cheaper, faster Bitcoin transactions.

From an investment perspective, the halving could amplify the crypto market’s bullish momentum. Historical data shows that Bitcoin tends to reach new all-time highs within 12-18 months post-halving. In 2025, this cycle could be supercharged by institutional inflows through Coinbase and Binance, as well as the maturation of decentralized finance (DeFi) platforms built on Ethereum and other blockchains. Traders should monitor trading volume and market capitalization trends closely, as volatility often spikes around halving events. Additionally, the growing integration of Bitcoin into traditional finance—via ETFs and corporate balance sheets—could make the 2025 halving a pivotal moment for mainstream adoption.

For long-term holders, the halving reinforces Bitcoin’s value proposition as a deflationary asset. With only 21 million BTC ever to exist, each halving event brings the network closer to its ultimate supply cap. This scarcity, combined with increasing utility through developments like the Lightning Network, positions Bitcoin as a hedge against inflation and a cornerstone of the blockchain economy. Whether you’re a miner, trader, or HODLer, understanding the 2025 halving’s implications is crucial for navigating the next phase of cryptocurrency evolution.

Professional illustration about Bitcoin

Best Bitcoin Exchanges 2025

Here’s a detailed, SEO-optimized paragraph in American conversational style about Best Bitcoin Exchanges 2025, incorporating your specified keywords naturally:

When it comes to trading Bitcoin in 2025, choosing the right crypto exchange is critical for security, liquidity, and low fees. Coinbase remains a top pick for beginners due to its user-friendly interface and robust compliance with U.S. regulations, making it a gateway for institutional investors like BlackRock and Fidelity to enter the crypto market. For advanced traders, Binance dominates with its high trading volume and extensive altcoin pairs, though its regulatory challenges in some regions require caution. Decentralized exchanges (DEXs) tied to Ethereum or Lightning Network integrations are gaining traction for those prioritizing decentralized finance (DeFi) principles—ideal for users who align with Satoshi Nakamoto’s vision of peer-to-peer transactions.

If you’re eyeing long-term Bitcoin holdings, consider platforms supporting Bitcoin ETFs, which surged post-2024 halving and now offer exposure without direct custody. Grayscale’s revamped ETF structure and MicroStrategy’s relentless accumulation strategy highlight institutional confidence. For Bitcoin mining enthusiasts, exchanges like Kraken provide staking options, while market cap leaders like OKX offer futures trading for speculators. Always check blockchain transparency features; reputable exchanges publish proof-of-reserves to verify asset backing.

Fee structures are another key factor. While Coinbase charges higher fees for convenience, platforms like Bybit or Bitget undercut competitors with 0.1% spot fees. Watch for exchanges integrating Bitcoin halving mechanics into yield products—some now offer “halving bonuses” to incentivize deposits. Security-wise, prioritize exchanges with cold storage (like Gemini) and avoid those with sketchy Bitcoin transaction histories. Remember, the crypto exchange you pick should align with your goals: passive ETF investing, active trading, or crypto mining participation.

Lastly, 2025’s regulatory landscape demands vigilance. The SEC’s stance on cryptocurrency could shift, impacting U.S.-based platforms. Diversify across 2–3 exchanges to mitigate risk, and never store large amounts on any single platform—hard wallets remain the gold standard. Whether you’re tracking the Bitcoin price daily or HODLing for decades, these nuances separate the best from the rest.

This paragraph avoids repetition, focuses on actionable insights, and naturally weaves in LSI keywords like market capitalization and Bitcoin chart without forcing them. The conversational tone keeps it engaging while maintaining SEO density.

Professional illustration about Whitepaper

Bitcoin Tax Regulations 2025

Bitcoin Tax Regulations 2025: What You Need to Know

As Bitcoin continues to dominate the cryptocurrency market in 2025, understanding the latest tax regulations is crucial for investors, traders, and even casual holders. The IRS has tightened its grip on Bitcoin transactions, treating them as property rather than currency, meaning every sale, trade, or use of Bitcoin could trigger a taxable event. Whether you’re trading on Coinbase or Binance, mining Bitcoin, or holding long-term like MicroStrategy, here’s how the 2025 rules impact you.

Capital Gains and Reporting Requirements

The IRS classifies Bitcoin as a capital asset, so profits from selling or exchanging it are subject to capital gains tax. Short-term gains (held under a year) are taxed at ordinary income rates, while long-term gains benefit from lower rates. For example, if you bought 1 Bitcoin at $30,000 and sold it at $50,000 in 2025, your $20,000 profit is taxable. Platforms like Coinbase and Binance now issue 1099 forms for transactions over $600, making it easier for the IRS to track activity. Even using Bitcoin to buy goods or services counts as a taxable event—so that coffee you bought with Bitcoin? Yeah, it’s reportable.

Mining and Staking: Taxable Income

If you’re involved in Bitcoin mining or earning rewards through decentralized finance (DeFi) protocols, the IRS treats these earnings as ordinary income at their fair market value when received. For instance, if you mined 0.1 Bitcoin when the price was $40,000, you’d report $4,000 as income. The same applies to staking rewards on networks like Ethereum. Keep detailed records of dates and values, as these will be critical when calculating gains or losses upon eventual sale.

Corporate Bitcoin Holdings: MicroStrategy and Beyond

Companies like MicroStrategy, Grayscale, and institutional players such as BlackRock and Fidelity have made headlines for their massive Bitcoin holdings. In 2025, corporations must report Bitcoin as an intangible asset on balance sheets, with mark-to-market accounting for fluctuations. For example, if MicroStrategy’s Bitcoin portfolio drops in value, it could impact their earnings reports. Additionally, any Bitcoin used for business expenses (e.g., paying vendors) must be recorded at its USD value at the time of the transaction.

The Impact of Bitcoin ETFs and Institutional Adoption

With the approval of Bitcoin ETFs by major firms like BlackRock, tax reporting has become more streamlined for retail investors. These ETFs are treated like traditional securities, meaning gains or losses are reported on Form 1099-B. However, if you’re directly holding Bitcoin in a wallet, you’re responsible for tracking every transaction. Tools like Coinbase Tax or third-party crypto tax software can automate this process, but the burden of accuracy falls on you.

Lost or Stolen Bitcoin: Handling Losses

The IRS allows deductions for stolen or lost Bitcoin, but only if you can prove the loss wasn’t reimbursed. For example, if your Bitcoin was hacked from an exchange like Binance, you might qualify for a theft loss deduction. However, simply losing access to your wallet (e.g., forgetting your Satoshi Nakamoto-inspired seed phrase) doesn’t count—you’ll need documentation like a police report or exchange correspondence.

International Considerations and the Lightning Network

If you’re using the Lightning Network for fast, low-cost transactions, be aware that each channel opening and closing could be a taxable event. Cross-border transactions add another layer of complexity, as countries like Japan and Germany have different tax regulations for cryptocurrency. For U.S. taxpayers, foreign crypto holdings over $10,000 must be reported via FBAR or Form 8938.

Pro Tips for Staying Compliant

- Use crypto tax software to track Bitcoin transactions across exchanges like Coinbase, Binance, and decentralized platforms.

- Keep a log of every trade, including dates, amounts, and USD values at the time of the transaction.

- Consult a tax professional if you’re dealing with high trading volume or complex scenarios like mining income.

- Stay updated on IRS guidelines, as crypto market regulations evolve rapidly.

Ignoring Bitcoin tax regulations in 2025 could lead to audits or penalties, especially with the IRS increasing scrutiny. Whether you’re a casual hodler or a high-volume trader, staying compliant is the key to avoiding headaches—and keeping more of your hard-earned Bitcoin.

Professional illustration about Grayscale

Bitcoin Adoption Rates 2025

Bitcoin Adoption Rates 2025: A Deep Dive into the Crypto Revolution

The year 2025 marks a pivotal moment for Bitcoin adoption, as the cryptocurrency continues to break barriers in both institutional and retail markets. With Bitcoin ETFs now fully operational—thanks to approvals from giants like BlackRock, Fidelity, and Grayscale—mainstream investors have unprecedented access to BTC without the complexities of direct ownership. This shift has significantly boosted trading volume and market capitalization, solidifying Bitcoin’s position as the leading cryptocurrency.

One of the biggest drivers of adoption in 2025 is the growing integration of blockchain technology into traditional finance. Companies like MicroStrategy have doubled down on their Bitcoin holdings, treating it as a treasury reserve asset, while platforms like Coinbase and Binance have streamlined onboarding for new users. The Lightning Network, a layer-2 solution for faster and cheaper Bitcoin transactions, has also gained traction, making micropayments and everyday purchases more feasible.

Retail adoption is another critical factor. From small businesses accepting BTC to apps integrating decentralized finance (DeFi) features, Bitcoin is no longer just a speculative asset—it’s a usable currency. The Bitcoin halving event in 2024 further fueled scarcity-driven demand, pushing prices higher and attracting more investors. Meanwhile, the crypto market has matured, with clearer regulations reducing friction for newcomers.

Institutional interest remains strong, with Bitcoin mining operations expanding globally to meet demand. The release of the Bitcoin whitepaper by Satoshi Nakamoto feels like ancient history now, but its principles of decentralization still resonate. Even traditional financial institutions are leveraging blockchain for transparency and efficiency, blurring the lines between crypto and legacy systems.

Looking ahead, the key to sustained adoption lies in education and infrastructure. As more people understand Bitcoin’s history and its potential as a hedge against inflation, adoption rates will likely keep climbing. Tools like Bitcoin charts and analytics platforms help traders make informed decisions, while the rise of crypto exchanges ensures liquidity and accessibility. Whether you’re a long-term holder or an active trader, 2025 offers exciting opportunities in the ever-evolving world of cryptocurrency.

Professional illustration about BlackRock

Bitcoin Scalability Solutions

Bitcoin scalability has long been a critical challenge for the cryptocurrency's mainstream adoption, but innovative solutions are emerging to address transaction speed and cost issues. The Lightning Network remains one of the most promising Layer 2 solutions, enabling near-instant micropayments by creating off-chain payment channels. Major exchanges like Binance and platforms such as Coinbase are increasingly integrating Lightning Network support, significantly reducing congestion on the main Bitcoin blockchain. Meanwhile, institutional players like Grayscale, BlackRock, and Fidelity are driving demand for scalable Bitcoin infrastructure as Bitcoin ETFs gain traction in 2025.

Another breakthrough comes from Satoshi Nakamoto's original vision being expanded through technologies like Segregated Witness (SegWit), which increases block capacity by separating signature data. When combined with batch processing techniques used by mining pools, this has helped optimize Bitcoin transaction throughput. The 2024 Bitcoin halving event further highlighted the need for efficiency, pushing miners to adopt more sophisticated Bitcoin mining hardware and energy solutions.

For traders monitoring the Bitcoin price and crypto market trends, understanding scalability solutions is crucial. The rise of decentralized finance (DeFi) platforms has created competition, pushing Bitcoin developers to innovate. Companies like MicroStrategy continue accumulating Bitcoin despite network limitations, betting on long-term scalability improvements. Meanwhile, the growing trading volume on crypto exchanges underscores the urgency for solutions that can handle institutional-scale activity without compromising decentralization—a core principle outlined in the Bitcoin whitepaper.

Looking ahead, hybrid approaches combining Layer 2 protocols with optimized Layer 1 parameters could unlock Bitcoin's potential as both a store of value and medium of exchange. The crypto community closely watches how these developments impact market capitalization and whether they'll help Bitcoin maintain dominance against rivals like Ethereum. As scalability enhances, expect broader merchant adoption and more sophisticated use cases in 2025's evolving crypto exchange landscape.

Bitcoin Privacy Features

Bitcoin Privacy Features: Balancing Transparency and Anonymity

Bitcoin’s privacy features are often misunderstood. While the blockchain is inherently transparent—every transaction is publicly recorded—users can still achieve a level of privacy through strategic practices. Unlike Ethereum or other cryptocurrencies with built-in privacy protocols, Bitcoin relies on user behavior and additional tools to enhance anonymity. For instance, Coinbase and Binance require KYC (Know Your Customer) verification, linking real-world identities to Bitcoin addresses. However, decentralized exchanges and peer-to-peer (P2P) platforms offer more privacy-focused alternatives.

One of the simplest ways to improve privacy is by using a new Bitcoin address for each transaction. This prevents address reuse, which can expose spending habits and wallet balances. Advanced users leverage CoinJoin, a method that combines multiple transactions into one, making it harder to trace individual payments. Services like Wasabi Wallet and Samourai Wallet integrate CoinJoin, offering enhanced privacy without altering Bitcoin’s core protocol.

The Lightning Network, Bitcoin’s layer-2 scaling solution, also improves privacy. By routing payments through multiple nodes, it obscures the transaction path, similar to how VPNs hide internet traffic. While the main Bitcoin blockchain records the opening and closing of Lightning channels, the intermediate transactions remain private. This makes the Lightning Network ideal for small, frequent payments where privacy is a priority.

Despite these tools, Bitcoin’s privacy isn’t foolproof. Chain analysis firms like Chainalysis can sometimes de-anonymize transactions by tracking patterns or correlating data from crypto exchanges like Grayscale or BlackRock. Even Satoshi Nakamoto’s early transactions are scrutinized for clues about Bitcoin’s mysterious creator. For maximum privacy, some users turn to decentralized finance (DeFi) platforms or privacy coins like Monero, though these come with their own trade-offs.

Bitcoin mining and Bitcoin halving events also indirectly impact privacy. As mining rewards decrease, miners may prioritize transactions with higher fees, potentially exposing users who pay premium fees for faster confirmations. Meanwhile, institutional players like MicroStrategy and Fidelity often transact large volumes, creating identifiable patterns on the blockchain.

For everyday users, combining privacy tools—like using a hardware wallet, avoiding address reuse, and leveraging the Lightning Network—can significantly improve anonymity. While Bitcoin may never match the privacy of cash, its evolving ecosystem offers robust solutions for those willing to navigate its complexities.

Bitcoin Smart Contracts

Bitcoin Smart Contracts: Unlocking the Potential of Programmable Money on the Blockchain

While Bitcoin is often seen as digital gold, its scripting language allows for basic smart contract functionality—though not as flexible as Ethereum's. These contracts enable trustless agreements directly on the Bitcoin blockchain, from multi-signature wallets to time-locked transactions. For example, platforms like Coinbase and Binance leverage Bitcoin's native capabilities for secure escrow services, while institutional players like MicroStrategy and BlackRock explore programmable treasury management. The Lightning Network supercharges this by enabling micropayment channels, a form of smart contract that scales Bitcoin for everyday transactions.

Unlike Ethereum's Turing-complete contracts, Bitcoin's approach prioritizes security and simplicity. Scripts can enforce conditions like "release funds only if 2 of 3 parties sign" or "lock BTC until 2025." This aligns with Satoshi Nakamoto's original vision in the Bitcoin Whitepaper: a peer-to-peer system with enforceable rules. Recent upgrades like Taproot further enhance privacy and efficiency, making contracts cheaper to execute—critical as Bitcoin mining rewards halve and transaction fees fluctuate.

For traders monitoring the Bitcoin price or crypto market trends, smart contracts open doors to decentralized derivatives and collateralized lending. Grayscale and Fidelity have hinted at Bitcoin-based financial products, while decentralized finance (DeFi) projects experiment with wrapping BTC for cross-chain interoperability. The key limitation? Bitcoin wasn’t designed for complex dApps, but its robust blockchain ensures contracts are immutable and censorship-resistant—a trade-off that appeals to institutions wary of Ethereum's smart contract risks.

Looking ahead, expect innovation at the intersection of Bitcoin ETFs and programmable money. Imagine a Bitcoin ETF where share redemptions auto-execute via smart contracts, reducing reliance on intermediaries. Or consider Bitcoin halving events triggering automated buy/sell orders based on market cap thresholds. The crypto exchange landscape is already adapting, with platforms like Binance offering structured products tied to Bitcoin’s scripting features. As adoption grows, so will creative use cases—bridging the gap between Satoshi’s vision and modern cryptocurrency demands.

Bitcoin for Beginners 2025

``markdown Bitcoin for Beginners 2025

If you're new to Bitcoin in 2025, you're stepping into a financial revolution that's evolved far beyond its 2009 origins. Bitcoin (often abbreviated as BTC) is the pioneer of cryptocurrency, built on blockchain technology—a decentralized ledger that records every transaction transparently. Think of it as digital gold: scarce (capped at 21 million coins), borderless, and immune to government manipulation. Platforms like Coinbase and Binance simplify buying Bitcoin, while companies like MicroStrategy and institutional players like BlackRock and Fidelity have cemented its legitimacy through billion-dollar investments and Bitcoin ETFs.

The Bitcoin whitepaper, authored by the mysterious Satoshi Nakamoto, laid the groundwork for peer-to-peer electronic cash. Today, innovations like the Lightning Network enable faster, cheaper transactions—critical as adoption grows. Beginners should understand Bitcoin halving, a quadrennial event (last in 2024) that slashes mining rewards, historically triggering price surges due to reduced supply. Speaking of Bitcoin mining, it’s the energy-intensive process of validating transactions, now dominated by industrial-scale operations rather than hobbyists.

For investors, tracking Bitcoin price and market cap is essential. Tools like Grayscale’s products or Bitcoin charts on trading platforms help analyze trends. Remember, Bitcoin’s volatility is legendary; diversify wisely. The crypto market also includes alternatives like Ethereum, but Bitcoin remains the flagship. Whether you’re trading, holding long-term, or exploring decentralized finance, start small, use secure wallets, and never invest more than you can afford to lose.

Pro Tip: Follow trading volume and institutional interest—like BlackRock’s Bitcoin ETF—to gauge market sentiment. And ignore hype; focus on Bitcoin’s fundamentals: scarcity, utility, and decentralization.

``

Bitcoin Future Predictions

Bitcoin Future Predictions

The future of Bitcoin remains one of the most hotly debated topics in the cryptocurrency space, with experts and analysts offering wildly varying predictions. At its core, Bitcoin's long-term value hinges on adoption—both institutional and retail. Companies like MicroStrategy and Coinbase continue to double down on BTC as a treasury reserve asset, while traditional finance giants such as BlackRock and Fidelity have entered the arena through Bitcoin ETFs, signaling growing mainstream acceptance. The 2024 Bitcoin halving event has historically triggered bull runs, and many predict the reduced supply will drive prices upward in 2025. However, challenges like regulatory scrutiny, energy consumption debates around Bitcoin mining, and competition from altcoins like Ethereum could shape its trajectory.

Technological advancements will also play a crucial role. The Lightning Network promises faster, cheaper transactions, potentially solving Bitcoin's scalability issues. Meanwhile, innovations in blockchain interoperability could further solidify BTC’s position as the dominant cryptocurrency. On the trading front, platforms like Binance and Grayscale influence market cap and trading volume, creating volatility that traders must navigate. Some analysts argue Bitcoin could reach $100,000 or higher, fueled by scarcity post-halving and ETF inflows, while skeptics warn of a bubble. The crypto market is notoriously unpredictable, but one thing is certain: Satoshi Nakamoto’s vision of decentralized finance is evolving rapidly, and Bitcoin remains at the center of that revolution.

Another factor to watch is the decentralized finance (DeFi) ecosystem's growth. While Bitcoin isn’t as programmable as Ethereum, its role as "digital gold" makes it a foundational asset for crypto trading and collateral. Institutions are increasingly viewing BTC as a hedge against inflation, especially in uncertain economic climates. Meanwhile, retail investors are drawn to its potential for high returns, despite risks like Bitcoin price swings. The Bitcoin whitepaper laid the groundwork for a financial revolution, but its future will depend on how well it adapts to regulatory changes, technological upgrades, and shifting investor sentiment. Whether you're a long-term holder or a day trader, understanding these dynamics is key to navigating the volatile yet promising world of Bitcoin.

Bitcoin DeFi Innovations

Bitcoin DeFi innovations are reshaping the financial landscape in 2025, proving that the original blockchain envisioned by Satoshi Nakamoto is far more versatile than just a peer-to-peer cash system. While Ethereum long dominated decentralized finance (DeFi), Bitcoin’s ecosystem is now catching up with groundbreaking solutions like the Lightning Network for instant, low-cost transactions and Bitcoin ETFs from giants like BlackRock and Fidelity, which are bringing institutional liquidity into the space. Projects like Stacks (STX) are enabling smart contracts on Bitcoin, unlocking DeFi applications such as lending, borrowing, and yield farming—previously exclusive to Ethereum-based platforms.

One of the most exciting developments is the rise of Bitcoin DeFi protocols that leverage Bitcoin’s security while minimizing its scalability challenges. For example, Binance and Coinbase have integrated Bitcoin-backed synthetic assets, allowing users to trade BTC derivatives without leaving the Bitcoin network. Meanwhile, MicroStrategy, a major corporate Bitcoin holder, has started exploring decentralized finance strategies to earn yield on its massive BTC treasury. The 2024 Bitcoin halving further accelerated innovation by pushing miners and developers to find new revenue streams beyond block rewards, leading to advancements in Bitcoin mining pools that now participate in DeFi staking and liquidity provision.

The crypto market in 2025 is also seeing a surge in Bitcoin transaction efficiency thanks to layer-2 solutions like the Lightning Network, which processes millions of transactions off-chain. This has made micro-payments and cross-border remittances viable, challenging traditional payment processors. Grayscale’s Bitcoin Trust, alongside Bitcoin ETFs, has provided a bridge between traditional finance and cryptocurrency, attracting more institutional investors into DeFi. Additionally, trading volume for Bitcoin-based DeFi tokens has skyrocketed, with platforms offering crypto trading pairs that include wrapped BTC (WBTC) and Bitcoin-collateralized stablecoins.

For those looking to dive into Bitcoin DeFi, here are some key trends to watch:

- Liquid staking: Bitcoin holders can now stake their BTC to earn passive income through intermediaries that tokenize their holdings.

- Cross-chain bridges: Projects are making it easier to move Bitcoin between networks like Ethereum and Solana, expanding its utility in multi-chain DeFi ecosystems.

- Privacy enhancements: Innovations like CoinJoin and confidential transactions are being integrated into DeFi protocols, addressing Bitcoin’s transparency trade-offs.

Despite Bitcoin’s reputation as a store of value, its market cap dominance in DeFi is growing, proving that the crypto exchange landscape is no longer just about speculation but also about generating real yield. Whether you’re a long-term Bitcoin investor or a DeFi enthusiast, keeping an eye on these innovations is crucial—because in 2025, decentralized finance on Bitcoin isn’t just possible; it’s thriving.