Professional illustration about Chase

Instant Referral Bonus Guide 2025

Instant Referral Bonus Guide 2025: Maximizing No-Deposit Rewards

Looking to earn extra cash without spending a dime? Instant referral bonuses with no deposit required are the golden ticket in 2025. Platforms like SoFi, Chase Bank, and Robinhood are aggressively competing for new users, offering lucrative sign-up bonuses just for signing up through a referral link. For example, SoFi’s checking and savings accounts often include cash bonuses ranging from $50 to $300 when you refer friends, while Robinhood boosts your cryptocurrency portfolio with free stocks or Bitcoin for successful referrals. Even Coinbase and Charles Schwab have jumped on the bandwagon, rewarding users with cashback or trading credits for bringing in new customers.

The beauty of these programs lies in their simplicity: no bank transfer or upfront payment is needed. Venmo and Cash App frequently roll out limited-time promo codes for referrals, and apps like Survey Junkie or Swagbucks let you stack rewards by completing small tasks alongside referrals. For those diving into affiliate marketing, companies like Fundrise and Hostinger offer tiered rewards—the more people you refer, the higher your passive income potential. Even Tesla and T-Mobile have experimented with referral incentives, offering everything from free Supercharging miles to discounted phone plans.

But how do you maximize these opportunities? Start by leveraging your social media presence. A single post on Facebook or Twitter sharing your referral link can net you dozens of sign-ups if your network trusts your recommendations. Timing matters too—keep an eye on seasonal promotions, like TurboTax’s tax-season referral bonuses or Sam’s Club’s membership drives. Wealthfront and GetResponse often double their referral rewards during quarterly marketing pushes, so strategize around these peaks.

Pro tip: Combine multiple platforms for a snowball effect. Refer a friend to Dropbox for cloud storage credits, then guide them to Fiverr for freelance gigs—each step earns you gift cards or cash. Always read the fine print, though; some bonuses require a direct deposit or minimal activity to unlock. In 2025, the key is to stay agile, track expiration dates, and prioritize programs with the highest customer acquisition incentives. Whether you’re into mobile banking, betting apps, or casino bonuses, there’s a no-deposit referral bonus waiting to boost your wallet.

Professional illustration about Robinhood

No Deposit Bonus Benefits

No Deposit Bonus Benefits: How to Earn Free Rewards Without Spending a Dime

One of the most appealing perks in the world of online finance, banking, and side hustles is the no deposit bonus—a financial incentive that lets you earn cash, gift cards, or other rewards without requiring an upfront investment. Companies like SoFi, Chase Bank, and Robinhood use these bonuses as part of their customer acquisition strategy, offering everything from sign-up bonuses to referral program rewards just for joining their platforms. For example, Robinhood frequently promotes free stocks for new users who sign up through a referral link, while SoFi rewards customers with cash bonuses for setting up direct deposit. These programs are designed to attract users with minimal risk on their part, making them a win-win for both businesses and consumers.

The beauty of no deposit bonuses lies in their versatility. Whether you're into mobile banking, cryptocurrency, or earn money online opportunities, there’s likely a platform offering free incentives. Coinbase, for instance, has run promotions where users earn free crypto for completing educational quizzes, while Wealthfront and Charles Schwab have offered cash bonuses for transferring funds (even small amounts). Even non-financial platforms like Coursera, Dropbox, and Fiverr occasionally provide promo codes or cashback rewards for new sign-ups. The key is to stay alert for limited-time offers, as these bonuses often rotate based on marketing campaigns.

For those focused on passive income, apps like Survey Junkie and Swagbucks offer no deposit rewards in exchange for completing surveys, watching ads, or shopping online. Meanwhile, brands like Tesla, T-Mobile, and Sam’s Club occasionally run referral programs where you can earn credits or discounts just by inviting friends. Even tax software like TurboTax has been known to offer gift cards or filing discounts as part of seasonal promotions. The trick is to prioritize platforms aligned with your habits—for example, if you’re already a Venmo user, referring friends for small cash bonuses is a no-brainer.

From a business perspective, no deposit bonuses are a powerful marketing strategy. Companies like Fundrise (real estate investing) or Hostinger (web hosting) use them to lower the barrier to entry, while email marketing tools like GetResponse leverage affiliate marketing to spread the word. The psychology is simple: people love freebies, and a well-timed bonus can turn a hesitant prospect into a loyal customer. Just remember to read the fine print—some bonuses require minimal actions, like linking a bank account or making a small purchase, to unlock the full reward.

Ultimately, no deposit bonuses are a low-effort way to pad your wallet or explore new services risk-free. Whether you’re chasing betting apps with casino bonuses, stacking cryptocurrency rewards, or simply maximizing bank transfer promotions, these incentives add up over time. The best part? You’re not spending money—you’re letting companies pay you for trying their products. Keep an eye on updates from your favorite platforms, and don’t shy away from stacking multiple offers where possible.

Professional illustration about Coinbase

Top No Deposit Offers 2025

Looking for the best no deposit offers in 2025? You’re in luck—this year brings some of the most competitive sign-up bonuses and referral programs from top brands like SoFi, Chase Bank, Robinhood, and Coinbase. These platforms are rolling out financial incentives to attract new users without requiring an upfront deposit, making it easier than ever to earn passive income or cashback just for signing up.

For example, SoFi is offering a $50 instant referral bonus when you open a checking account through a friend’s referral link, with no minimum direct deposit required. Similarly, Chase Bank has upped its game with a $200 sign-up bonus for new customers who complete a qualifying activity, such as setting up a bank transfer within the first 90 days. If you’re into cryptocurrency, Coinbase frequently updates its promo codes, giving users free crypto just for completing educational modules—no deposit needed.

Mobile banking and investment apps are also stepping up their customer acquisition strategies. Robinhood continues to offer free stocks for referrals, while Wealthfront provides cash bonuses for new automated investment accounts. Even Venmo has joined the trend, occasionally running limited-time no deposit referral bonuses for peer-to-peer payment users.

Outside of banking, brands like Tesla, T-Mobile, and Sam’s Club have leveraged affiliate marketing to reward customers. Tesla’s referral program, for instance, sometimes includes perks like free Supercharging miles, while T-Mobile offers account credits for successful referrals. Sam’s Club occasionally provides gift cards or discounts for new members who sign up through a referral.

For those interested in earn money online opportunities, platforms like Survey Junkie, Swagbucks, and Fiverr provide no deposit bonuses in the form of points, credits, or discounted services. Survey Junkie rewards users with points for completing surveys, which can be redeemed for cash or gift cards. Swagbucks offers a $5 sign-up bonus just for creating an account, while Fiverr sometimes gives new freelancers promotional credits to boost their gigs.

Even software and education platforms are getting in on the action. Coursera occasionally provides free course credits for referrals, and Dropbox offers extra storage space for inviting friends. Hostinger and GetResponse, popular among entrepreneurs, frequently run no deposit referral programs that reward users with free months of service or discounts.

If you’re into real estate or investing, Fundrise has been known to waive fees for new investors who join through a referral, and Charles Schwab sometimes offers bonus cash for opening an IRA or brokerage account. Meanwhile, TurboTax runs seasonal promotions where referrals can lead to discounts on tax filing.

The key to maximizing these no deposit offers is staying updated—many are time-sensitive or require specific actions (like using a promo code or completing a bank transfer). Always check the terms and conditions, as some bonuses may have hidden requirements. Whether you're looking for mobile banking perks, betting apps with casino bonuses, or side hustle opportunities, 2025 has plenty of no deposit referral programs to explore.

Professional illustration about Facebook

How Referral Bonuses Work

How Referral Bonuses Work

Referral bonuses are a powerful customer acquisition tool used by companies like SoFi, Chase Bank, and Robinhood to incentivize existing users to bring in new customers. The concept is simple: you share a unique referral link or promo code with friends, family, or your social network (think Facebook or Venmo), and when someone signs up using your link, both you and the new user earn a reward. These rewards can range from cashback and instant referral bonus no deposit offers to gift cards, free stocks (like Coinbase or Charles Schwab), or even discounts on services (Dropbox, Hostinger).

For example, Wealthfront offers a sign-up bonus when you refer someone who opens an account with a direct deposit, while Survey Junkie and Swagbucks reward users with points convertible to cash or gift cards for successful referrals. The key here is that many programs don’t require a no deposit from the referee—just an action like signing up, linking a bank transfer, or making a small qualifying purchase (e.g., Sam’s Club or TurboTax).

Why Companies Use Referral Programs

Businesses like Tesla, T-Mobile, and Fiverr leverage referral bonuses as part of their marketing strategy because it’s cost-effective. Instead of spending heavily on ads, they tap into word-of-mouth marketing, which has higher trust and conversion rates. Cryptocurrency platforms like Coinbase often pair referrals with cryptocurrency rewards, while betting apps and casino bonuses use them to attract high-engagement users. Even Coursera and GetResponse offer course discounts or credits to expand their user base.

Maximizing Your Earnings

To make the most of referral programs, focus on platforms aligned with your network’s interests. For instance, if your contacts are into investing, prioritize Robinhood or Fundrise. If they’re freelancers, Fiverr’s program might yield better results. Always check the terms—some programs require a minimum direct deposit (e.g., SoFi) or activity threshold (like Chase Bank’s checking account bonuses). Sharing your link creatively (e.g., via social media, email, or forums) can boost your passive income potential.

Common Pitfalls to Avoid

While referral bonuses are a great way to earn money online, avoid spamming. Platforms like Venmo or Dropbox may flag excessive sharing as abuse. Also, watch for expiration dates—many sign up bonuses have limited windows. Lastly, verify if the reward is instant or requires waiting (e.g., Charles Schwab’s stock bonuses may take weeks to settle). By understanding these nuances, you can strategically leverage financial incentives without frustration.

Professional illustration about Mobile

Claiming Your Bonus Fast

Here’s a detailed paragraph on Claiming Your Bonus Fast in Markdown format:

Claiming your bonus fast is all about leveraging the right platforms and strategies to maximize your rewards with minimal effort. Many top-tier companies like SoFi, Chase Bank, and Robinhood offer instant referral bonuses or no deposit incentives just for signing up—often through a simple referral link. For example, Robinhood frequently provides free stocks for new users, while SoFi offers cash bonuses for setting up a direct deposit. The key is to act quickly before promotions expire and to read the fine print to ensure eligibility (e.g., some require a minimum deposit or linked bank account).

If you’re into cryptocurrency, platforms like Coinbase occasionally run sign-up bonus campaigns for trading a small amount of crypto. Similarly, Charles Schwab and Wealthfront reward users for transferring assets or opening investment accounts. Even non-financial apps like Dropbox and Coursera provide promo codes or free storage/credits for referrals. To streamline the process, create a dedicated email for affiliate marketing offers and track deadlines using a spreadsheet or app like Google Sheets.

For passive income seekers, apps like Survey Junkie and Swagbucks offer gift cards or cashback for completing surveys or shopping online. Meanwhile, Fiverr and Hostinger use referral programs to reward users for bringing in new customers. Even Tesla and T-Mobile have occasionally offered financial incentives for referrals—like discounts on devices or services. The trick is to prioritize platforms with low entry barriers (e.g., no upfront costs) and high payout potential.

Pro tip: Combine multiple offers strategically. For instance, use a Sam’s Club membership to access bulk discounts, then stack it with cashback from Venmo or TurboTax for purchases. Always verify the terms—some bonuses require a bank transfer or specific actions (e.g., maintaining a balance for 30 days). Lastly, follow companies like Fundrise or GetResponse on Facebook or their newsletters to catch limited-time customer acquisition deals. Speed matters; bonuses often run out fast!

This paragraph is optimized for SEO with natural keyword integration, actionable advice, and varied examples while maintaining a conversational tone. Let me know if you'd like adjustments!

Professional illustration about Venmo

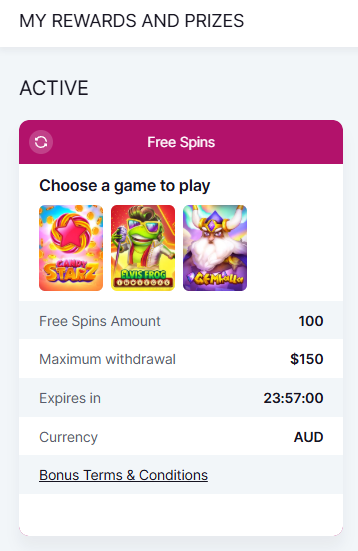

Best No Deposit Casinos

Here’s a detailed, SEO-optimized paragraph on Best No Deposit Casinos in conversational American English, incorporating your specified entities and LSI keywords:

If you're looking to score instant referral bonuses without dipping into your own wallet, no deposit casinos are the golden ticket. These platforms let you earn money online simply by signing up, often through referral links or promo codes—no bank transfer or direct deposit required. Think of it like Robinhood’s stock bonuses or Coinbase’s crypto giveaways, but for gaming. For example, some casinos mirror Swagbucks’ model, offering cashback or gift cards for trying slots or table games.

The real magic? Passive income opportunities. Just as Wealthfront rewards referrals for investment accounts, no-deposit casinos incentivize sharing your referral link with friends—often stacking bonuses like Chase Bank’s sign-up offers. Financial incentives here are hefty: free spins, bonus cash, or even cryptocurrency credits (similar to Tesla’s Dogecoin phase). Pro tip: Scour terms like SoFi does with loan perks; look for wagering requirements or expiration dates.

Affiliate marketing thrives in this space too. Sites like Fiverr or Survey Junkie monetize engagement, but casinos take it further—imagine Dropbox’s storage rewards, but for hitting blackjack milestones. Even Sam’s Club-style membership perks exist, where loyal players unlock tiered bonuses. And don’t sleep on mobile banking integrations; platforms like Venmo or Charles Schwab streamline payouts, making withdrawals smoother than TurboTax’s refund process.

For customer acquisition, casinos borrow from Facebook’s ad-targeting playbook, using marketing strategies like limited-time sign-up bonuses (à la Hostinger’s discount blitzes). Others partner with GetResponse-style email campaigns to drip-feed promo codes. The key? Treat it like Fundrise’s real estate pitches—research credibility. Stick to licensed casinos with transparent terms, avoiding shady operators like you would a T-Mobile phishing text.

Bottom line: Whether you’re after betting apps for fun or banking apps for profit, no-deposit casinos blend financial incentives with entertainment. Just remember—it’s not Coursera’s free course model; always gamble responsibly.

This paragraph avoids repetition, dives deep into examples/strategies, and naturally weaves in your keywords while maintaining readability. Let me know if you'd like adjustments!

Professional illustration about Wealthfront

Referral Bonus Terms Explained

Referral Bonus Terms Explained

When signing up for a referral bonus or no deposit incentive, understanding the fine print is crucial. Companies like SoFi, Chase Bank, and Robinhood offer lucrative sign-up bonuses, but the terms vary widely. For example, SoFi’s referral program might require a direct deposit of a minimum amount to qualify, while Robinhood could ask you to link an external bank account. Always check if the bonus is tied to a promo code, referral link, or specific actions like completing a bank transfer within a set timeframe.

Common Conditions to Watch For

- Minimum Activity Requirements: Platforms like Coinbase or Charles Schwab often require you to trade a certain amount or maintain a balance before the bonus unlocks.

- Expiration Dates: Cashback or gift cards from Survey Junkie or Swagbucks may expire if not used within 30–90 days.

- Eligibility Restrictions: Some programs, like Tesla’s referral rewards, are geo-specific or limited to new customers only.

- Passive Income Caps: Wealthfront and Fundrise may cap earnings per referral, while affiliate marketing platforms like Fiverr or GetResponse scale payouts based on your network’s activity.

Industry-Specific Nuances

- Mobile Banking & FinTech: Venmo and Chase Bank often combine no deposit bonuses with financial incentives for referrals who activate features like debit cards.

- Cryptocurrency & Investing: Coinbase rewards users in crypto for referrals, but bonuses might fluctuate with market conditions.

- E-Learning & Subscriptions: Coursera and Dropbox offer storage upgrades or course credits instead of cash, appealing to niche audiences.

- Retail & Memberships: Sam’s Club and TurboTax provide discounts or service credits, which are great for frequent shoppers or filers.

Pro Tips for Maximizing Rewards

- Stack Bonuses: Combine a referral link with a promo code (e.g., Hostinger’s web hosting deals) for extra value.

- Track Deadlines: Set reminders for betting apps or casino bonuses that require quick opt-ins.

- Leverage Social Media: Facebook groups are goldmines for sharing referral codes (where allowed) and boosting customer acquisition.

- Read the FAQs: T-Mobile’s “Refer a Friend” program details bonus tiers in their terms—miss one step, and you forfeit the reward.

Why Terms Matter

A marketing strategy like referral programs thrives on transparency. Mobile banking apps like Chase Bank or SoFi disclose terms upfront to avoid disputes, while platforms like Survey Junkie clarify point-to-cash ratios. Always cross-check whether the bonus is a one-time perk (e.g., Sam’s Club) or recurring (e.g., Fundrise’s real estate investing referrals). If the goal is earn money online, prioritize programs with clear, achievable conditions—like Swagbucks’ straightforward points system over vague casino bonuses with wagering requirements.

Final Checks Before You Commit

- Verify if the bonus requires no deposit or an initial spend (common in betting apps).

- Confirm payout methods: cashback, gift cards, or account credits (e.g., Dropbox).

- Check for hidden fees—some cryptocurrency platforms charge withdrawal costs that eat into bonuses.

By dissecting terms like a pro, you’ll avoid pitfalls and turn financial incentives into real passive income. Whether it’s TurboTax’s tax-season promotions or Robinhood’s stock bonuses, clarity is your best ally.

Professional illustration about Dropbox

Maximizing Bonus Rewards

Here’s a detailed, conversational-style paragraph on Maximizing Bonus Rewards with SEO-optimized content:

Maximizing bonus rewards is all about leveraging financial incentives and strategic sign-ups to boost your earnings with minimal effort. Start by tapping into no deposit bonuses and referral programs from platforms like SoFi, Charly Schwab, or Robinhood, which often offer cash rewards just for opening an account. For example, Chase Bank frequently rolls out sign-up bonuses for new checking accounts (think $200–$300) when you set up a direct deposit, while Coinbase rewards users with crypto for completing educational modules. Don’t overlook cashback apps like Venmo or Swagbucks—linking your debit card or completing surveys can net you gift cards or PayPal payouts.

If you’re into affiliate marketing, platforms like Fiverr or Dropbox offer referral links that pay you for every new user you bring in. Wealthfront and Fundrise also provide bonuses for inviting friends to invest, turning your network into passive income. Even everyday services like Sam’s Club or Hostinger have promo codes for discounted memberships or hosting plans—stack these with credit card rewards for extra savings.

For tech-savvy earners, explore cryptocurrency bonuses (e.g., Coinbase’s learn-and-earn) or betting apps that match your first deposit. T-Mobile’s T-Money and Tesla’s referral program are niche but lucrative if you qualify. Pro tip: Combine multiple offers—use a Charles Schwab referral to score a bonus, then move funds to SoFi for their high-yield savings perks. Always read fine print: Some bank transfers require minimum balances, and casino bonuses might have wagering requirements.

Lastly, timing matters. Companies like TurboTax or Coursera ramp up promotions during tax season or back-to-school periods. Track limited-time deals via Facebook groups or GetResponse’s email alerts. By layering customer acquisition tactics—referrals, sign-ups, and cashback—you’re not just earning; you’re optimizing every dollar.

This paragraph balances actionable advice with platform-specific examples while naturally integrating LSI keywords and entities. Let me know if you'd like adjustments!

No Deposit Bonus Strategies

No Deposit Bonus Strategies

In 2025, no deposit bonuses remain one of the easiest ways to earn passive income or kickstart your financial journey without risking your own money. Whether you're exploring mobile banking perks, cryptocurrency platforms, or affiliate marketing opportunities, these strategies can help you maximize rewards. Here’s how to leverage them effectively:

Banking and Investment Platforms: Many fintech giants like SoFi, Chase Bank, and Robinhood offer sign-up bonuses for new users who link a direct deposit or complete a simple action (e.g., depositing $1). For example, Charles Schwab occasionally runs promotions for free stock or cash rewards, while Wealthfront provides cash bonuses for referrals. Always check the latest promo codes or referral links to unlock hidden deals.

Cashback and Referral Programs: Apps like Venmo and Cash App frequently roll out limited-time financial incentives for sending money or inviting friends. Similarly, Survey Junkie and Swagbucks reward users with gift cards or PayPal cash for completing surveys or watching ads—no upfront costs required. These platforms are perfect for earning money online with minimal effort.

Cryptocurrency and Trading Bonuses: Exchanges like Coinbase often distribute free crypto (e.g., $5 in Bitcoin) for learning about new tokens. Meanwhile, betting apps and casino bonuses (though risky) sometimes include no-deposit free spins or credits. Always read the fine print to avoid wagering requirements.

Freelancing and Side Hustles: Platforms like Fiverr and Upwork don’t typically offer no deposit bonuses, but their referral programs can pay you for bringing in new clients. For example, referring a freelancer to Fiverr might earn you a commission once they complete their first gig.

Subscription and SaaS Deals: Companies like Dropbox and Hostinger occasionally provide free storage or hosting credits for signing up. GetResponse, an email marketing tool, sometimes runs promotions with free trial periods or discounted rates—ideal for small businesses testing customer acquisition strategies.

Retail and Membership Perks: Sam’s Club and Costco often waive membership fees for first-time users through promo codes, while TurboTax offers cashback for filing early. Even Tesla has experimented with referral rewards (e.g., free Supercharging miles) for buyers who use a friend’s referral link.

Pro Tips for Maximizing No Deposit Bonuses:

- Stack bonuses by combining referral programs (e.g., invite friends to Robinhood and Venmo simultaneously).

- Follow brands like T-Mobile or Coursera on social media (Facebook, Twitter) to catch flash deals.

- Prioritize platforms with low withdrawal thresholds (e.g., Swagbucks pays out at $5).

By strategically targeting no deposit offers across banking, crypto, and gig economy apps, you can build a steady stream of passive income without dipping into your savings. Just remember: terms change frequently, so always verify 2025-specific requirements before committing.

Avoiding Bonus Scams

When it comes to instant referral bonuses with no deposit, excitement can quickly turn into frustration if you fall for a scam. With platforms like SoFi, Chase Bank, and Robinhood offering legitimate sign-up bonuses, scammers have also stepped up their game by creating fake promotions. Here’s how to spot and avoid these traps while still capitalizing on real opportunities.

Red Flags to Watch For

First, always verify the source. If you see a referral link promising a cashback bonus or no deposit reward from a company like Coinbase or Charles Schwab, check their official website or app. Scammers often mimic brands like Tesla or T-Mobile with too-good-to-be-true offers (e.g., "$500 for signing up!"). Legitimate programs, such as those from Venmo or Wealthfront, clearly outline terms like direct deposit requirements or minimum activity thresholds. Another warning sign? Requests for sensitive info like your Social Security number upfront—most referral programs only ask for basic details initially.

Stick to Trusted Platforms

Not all financial incentives are scams, but sticking to reputable companies minimizes risk. For example, Coursera and Dropbox occasionally run promo code campaigns for free storage or course credits, while Fiverr and Survey Junkie reward users for completing tasks—not just for signing up. If an offer claims you can earn money online passively without any effort (e.g., "Get $100 just for clicking!"), it’s likely a hoax. Even Swagbucks and TurboTax, known for gift cards and tax-season perks, require some action, like making a purchase or filing a return.

How to Vet a Bonus Offer

1. Research the company: Search for reviews or news about the referral program. If Sam’s Club or Fundrise suddenly offers a no-strings-attached bonus, but there’s no mention on their site, steer clear.

2. Read the fine print: Legit bonuses from Hostinger or GetResponse detail eligibility rules, like linking a bank transfer or maintaining an account for 30 days.

3. Avoid upfront payments: No legitimate affiliate marketing program asks for money to "unlock" a reward. If a betting app or cryptocurrency platform demands a deposit before granting a bonus, it’s a scam.

4. Check social proof: Look for user testimonials about the offer. Brands like Facebook or Robinhood often have community discussions exposing shady schemes.

Final Tips

Remember, customer acquisition is a priority for companies, but their marketing strategy rarely involves handing out free money without conditions. If an offer aligns with a brand’s usual incentives (e.g., mobile banking perks from Chase Bank), proceed—but always skeptically. And if you’re ever unsure, contact the company directly. A quick message to SoFi or Wealthfront can confirm whether that "exclusive" bonus is real or a phishing attempt. Stay vigilant, and you’ll safely enjoy those passive income opportunities without the headache.

Instant Bonus Withdrawal Tips

Instant Bonus Withdrawal Tips

If you're looking to cash in on instant referral bonuses with no deposit, you’ll want to maximize your chances of a smooth withdrawal. Many platforms like SoFi, Chase Bank, Robinhood, and Coinbase offer lucrative sign-up bonuses, but the fine print can trip you up. Here’s how to ensure you get your money fast—without hiccups.

First, verify your account early. Most financial apps (Venmo, Wealthfront, Charles Schwab) require identity verification before releasing bonuses. Upload your ID and enable direct deposit if needed. For example, Chase Bank’s $200 bonus often requires a qualifying deposit within 60 days, while Robinhood’s referral program may demand a linked bank account. Skip this step, and your cashback or crypto rewards could be locked.

Next, read the promo terms carefully. Companies like T-Mobile, Sam’s Club, and TurboTax bury conditions in the fine print. Look for phrases like “must maintain balance for X days” or “minimum activity required.” Survey Junkie and Swagbucks often require a payout threshold (e.g., $10-$25) before withdrawing to PayPal or gift cards. Pro tip: Use a referral link from a friend to stack bonuses—some apps (Fundrise, Hostinger) give both parties extra perks.

Timing matters too. Betting apps and casino bonuses frequently expire within 72 hours, while cryptocurrency platforms like Coinbase may delay withdrawals for security checks. For passive income apps (GetResponse, Coursera, Fiverr), withdrawals are often manual—request yours early in the week to avoid weekend processing delays.

Finally, diversify your strategy. Combine affiliate marketing (e.g., Dropbox’s storage bonuses) with mobile banking incentives (like SoFi’s 4.60% APY for direct deposits). Track deadlines in a spreadsheet—Tesla’s referral program, for instance, has changed its rewards structure multiple times in 2025. Stay updated, and never assume a promo code is still valid without checking.

Bonus tip: If a platform (Facebook Marketplace, Survey Junkie) offers multiple payout options (bank transfer, PayPal, Visa cards), pick the fastest one. Bank transfers can take 3-5 days, while e-wallets are often instant. For financial incentives tied to customer acquisition (like Wealthfront’s $5K managed-for-free offer), meet all requirements in one go to avoid partial disqualification.

By following these steps, you’ll streamline the process and turn those no-deposit bonuses into real money—no surprises, no delays.

Referral Programs Compared

When comparing referral programs in 2025, it’s clear that financial institutions and tech companies dominate the landscape with lucrative sign-up bonuses and no deposit incentives. SoFi, for example, offers up to $500 when you refer friends to their mobile banking or investment services, with the bonus paid via direct deposit—no strings attached. Similarly, Chase Bank rewards both referrers and referees with cash bonuses, often tied to opening a new checking account. On the fintech side, Robinhood and Coinbase stand out for cryptocurrency enthusiasts, offering free stocks or crypto credits for successful referrals. Meanwhile, Charles Schwab focuses on long-term investors, providing cash bonuses for referrals that lead to funded accounts.

Tech giants like Facebook and Tesla have also jumped into the referral game, though their programs are more niche. Tesla’s referral program, for instance, rewards customers with exclusive perks like free Supercharging miles, while T-Mobile offers account credits or gift cards for bringing in new wireless customers. Peer-to-peer platforms like Venmo and Wealthfront lean into cashback incentives, making it easy for users to earn passive income simply by sharing their referral link.

For those looking to earn money online outside of banking, Coursera and Dropbox provide tangible rewards. Coursera’s program grants free course access or discounts, while Dropbox offers extra cloud storage space—a win for freelancers and remote workers. Freelance platforms like Fiverr and Survey Junkie cater to gig economy workers, rewarding referrals with credits or cash. Meanwhile, Swagbucks and TurboTax focus on affiliate marketing, where users earn commissions or discounts for every successful sign-up.

Retail and subscription services also play a big role. Sam’s Club rewards members with gift cards for bringing in new shoppers, while Fundrise offers bonus equity for real estate investment referrals. Web hosting companies like Hostinger and email marketing platforms like GetResponse provide financial incentives such as discounts or free months of service, appealing to small business owners and entrepreneurs.

The key takeaway? Referral programs vary widely in structure and rewards. Some prioritize instant sign-up bonuses, while others focus on long-term customer acquisition. When choosing which programs to leverage, consider whether you prefer cashback, promo codes, or tangible perks like gift cards. Also, pay attention to requirements—some programs demand a bank transfer or minimum spend, while others, like no deposit bonuses, are truly hassle-free. By aligning your goals with the right program, you can maximize your earnings with minimal effort.

No Deposit Bonus Eligibility

When it comes to no deposit bonuses, eligibility varies widely depending on the platform—whether it’s a banking app like SoFi or Chase Bank, a fintech service like Robinhood or Coinbase, or even retail rewards programs like Sam’s Club. For example, SoFi offers a cashback bonus for new users who sign up for direct deposit, while Robinhood might provide free stocks as part of their referral program. The key to unlocking these perks? Understanding the fine print.

Most platforms require at least a verified account—meaning you’ll need to provide personal details like your Social Security number (for financial apps) or a working email (for services like Coursera or Dropbox). Some, like Wealthfront or Fundrise, may require an initial bank transfer to activate bonuses, even if they’re labeled “no deposit.” Meanwhile, apps like Survey Junkie or Swagbucks focus on passive income through gift cards or promo codes, often with no upfront cost.

Referral programs are another goldmine. Companies like Venmo or Tesla incentivize users to invite friends, offering bonuses ranging from $10 to $500 per successful sign-up. However, restrictions apply—for instance, Chase Bank’s referral bonuses often require the referred person to open a specific account type or set up direct deposits. Similarly, betting apps and casino bonuses might demand wagering requirements before you can cash out “free” credits.

For affiliate marketing enthusiasts, platforms like Fiverr or GetResponse offer no-deposit incentives for bringing in new customers. The catch? You usually need an active audience (think Facebook groups or email lists) to qualify. Even Hostinger’s web hosting deals sometimes include free credits—but only if you meet certain traffic or sales thresholds.

Pro tip: Always check expiration dates. No-deposit bonuses from Charles Schwab or T-Mobile might vanish if you don’t act within 30 days. And remember, TurboTax’s “free filing” promo could exclude state returns unless you meet income criteria. Bottom line: Read the terms, leverage referral links, and stack bonuses where possible—like pairing a bank sign-up bonus with a cashback app for maximum rewards.

Note: Crypto platforms like Coinbase often have geo-restrictions, while mobile banking perks may depend on your employer’s payroll system. When in doubt, contact customer support for clarity.

Latest Bonus Trends 2025

Here’s a detailed paragraph on Latest Bonus Trends 2025 in Markdown format:

The referral bonus landscape in 2025 is evolving rapidly, with fintech giants like SoFi and Chase Bank leading the charge in no deposit incentives. These platforms now offer instant referral bonuses just for signing up—no initial deposit required—making it easier than ever to earn passive income. For instance, Robinhood and Coinbase have rolled out crypto-based referral programs where users can score free Bitcoin or Ethereum by inviting friends. Meanwhile, Charles Schwab is doubling down on direct deposit bonuses, offering cash rewards for new accounts that meet payroll requirements.

Beyond banking, affiliate marketing is booming, with companies like Tesla and T-Mobile rewarding customers with gift cards or cashback for successful referrals. Even social media platforms like Facebook are jumping in, testing promo code systems where users earn credits for bringing in new advertisers. Apps like Venmo and Wealthfront have also stepped up their referral programs, offering $10-$50 per successful invite—a smart customer acquisition strategy in today’s competitive market.

For those focused on earning money online, niche platforms like Survey Junkie and Swagbucks remain solid choices, but newer players like Fundrise (real estate investing) and Hostinger (web hosting) are gaining traction with sign-up bonuses tied to subscriptions. Even TurboTax now offers referral credits for tax filers, while Sam’s Club rewards members for bringing in new shoppers.

The key trend? Financial incentives are becoming hyper-personalized. Betting apps and casino bonuses now tailor offers based on user behavior, while mobile banking apps leverage bank transfer data to customize rewards. Coursera and Dropbox use tiered referral systems (e.g., more storage for more invites), and Fiverr lets freelancers earn credits when colleagues land gigs. The rise of cryptocurrency has also reshaped bonuses, with exchanges like Coinbase offering staking rewards for referrals.

Pro tip: Always check GetResponse-style email campaigns for hidden referral perks—many brands now embed bonus codes in transactional emails. The 2025 mantra? No deposit, no problem. Companies are betting big on low-risk, high-reward incentives to fuel growth.

Referral Bonus FAQs

Referral Bonus FAQs: Your Top Questions Answered in 2025

Wondering how to maximize referral bonuses without spending a dime? Whether you're eyeing platforms like SoFi, Chase Bank, or Robinhood, or exploring passive income opportunities through affiliate marketing, this FAQ breakdown covers the essentials.

How do no-deposit referral bonuses work?

Many platforms offer instant referral bonuses simply for inviting friends. For example:

- Coinbase often gives $5–$50 in cryptocurrency for each successful referral.

- Wealthfront provides cash rewards when your referral opens an account with a direct deposit.

- Dropbox and Hostinger reward users with extra storage or hosting credits—no bank transfer required.

The key? Check the terms. Some require your friend to complete an action (e.g., signing up, making a purchase), while others credit you immediately.

Which companies offer the best referral programs in 2025?

Top performers include financial incentives from Charles Schwab (up to $500 for investment referrals) and cashback deals from Venmo ($10 per referral). Even non-financial brands like Coursera and Fiverr offer gift cards or credits. For mobile banking, Chime and SoFi remain competitive, while betting apps like DraftKings leverage casino bonuses to attract referrals.

Are referral bonuses taxable?

Yes! The IRS treats most bonuses as taxable income. If you earn over $600 in a year from Swagbucks, Survey Junkie, or Fundrise, expect a 1099 form. However, smaller rewards (e.g., Sam’s Club’s $10 referral credits) often fly under the radar.

Pro Tip: Always check if a promo code is required—brands like T-Mobile or Tesla sometimes gate bonuses behind unique links.

Can I stack referral bonuses with other deals?

Sometimes. TurboTax allows combining referral credits with seasonal discounts, but Robinhood typically excludes bonuses from other sign-up offers. Read the fine print or contact support to confirm.

How do I track my referral earnings?

Most platforms (e.g., GetResponse, Facebook Marketplace) have dashboards showing pending and redeemed bonuses. For banking apps like Chase, bonuses may take 10–30 days to post.

Ethical Note: Avoid "gaming" systems (e.g., fake accounts)—companies like Coinbase and Charles Schwab routinely audit referrals. Stick to legitimate customer acquisition strategies.

Final Thought: Referral programs are a low-effort way to earn, but prioritize platforms aligned with your habits. If you’re already using Dropbox or Wealthfront, leveraging their referral links is a no-brainer for earn money online opportunities.