Professional illustration about Technologies

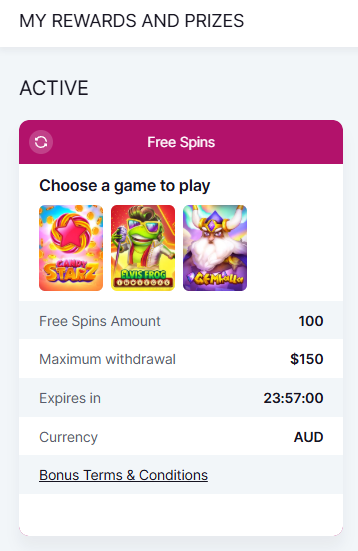

SoFi Banking in 2025

SoFi Banking in 2025

SoFi Technologies, Inc. has solidified its position as a leader in digital banking, offering a suite of financial services that cater to modern consumers. In 2025, SoFi’s platform continues to evolve, blending high-yield savings, investment options, and lending services into a seamless mobile app experience. With its acquisition of Technisys and Galileo, SoFi has enhanced its backend infrastructure, enabling faster transactions and more personalized financial insights. Members now enjoy advanced budgeting tools, real-time credit score monitoring, and even cryptocurrency integration—all designed to simplify financial planning.

The company’s partnership with Truist Securities and its NasdaqGS listing have further boosted investor confidence, making SoFi a go-to for those seeking competitive loan refinancing and auto insurance options. Beyond banking, SoFi’s cultural footprint is undeniable. The iconic SoFi Stadium in Hollywood Park, home to the LA Rams and Los Angeles Chargers, has become a hub for major events like Super Bowl LXI and the upcoming FIFA World Cup 26. This synergy between finance and entertainment underscores SoFi’s unique brand appeal.

For users, the benefits are clear: a user-friendly interface, robust member benefits, and an investment platform that demystifies wealth-building. Whether you’re saving for a home or exploring digital assets, SoFi’s 2025 offerings are tailored to meet diverse financial goals. The integration of YouTube Theater and American Airlines partnerships also adds lifestyle perks, proving that SoFi is more than just a bank—it’s a financial ecosystem built for the future.

Professional illustration about Stadium

SoFi Loans Explained

SoFi Loans Explained

When it comes to financial services, SoFi Technologies, Inc. has become a household name, offering a wide range of lending services designed to simplify financial planning. Whether you're looking for loan refinancing, personal loans, or student loan options, SoFi’s digital banking platform provides competitive rates and flexible terms. One of the standout features is their member benefits, which include career coaching, exclusive events (like those at SoFi Stadium, home to the LA Rams and Los Angeles Chargers), and even discounts for big-ticket events such as the FIFA World Cup 26 or Super Bowl LXI.

SoFi’s mobile app makes managing loans effortless, with tools for credit score monitoring, budgeting tools, and real-time financial insights. For example, their investment platform allows users to explore investment options like cryptocurrency or high-yield savings accounts, all while keeping an eye on their loan repayment progress. The company’s acquisition of Galileo and Technisys has further strengthened its tech infrastructure, ensuring seamless digital banking experiences.

If you're considering a SoFi loan, here’s what you need to know:

- Personal Loans: Ideal for debt consolidation, home improvements, or major purchases, with fixed rates and no hidden fees.

- Student Loan Refinancing: Competitive APRs for graduates looking to lower monthly payments or shorten loan terms.

- Auto Loan Refinancing: Save money by refinancing existing car loans through SoFi’s partnership with American Airlines for travel perks.

Analysts at Truist Securities and NasdaqGS have highlighted SoFi’s growth in the fintech space, particularly its integration of financial services under one roof. Plus, with venues like YouTube Theater and Hollywood Park hosting events, SoFi isn’t just about loans—it’s about building a community. Whether you're in San Francisco or beyond, their auto insurance partnerships and member benefits make them a top choice for modern borrowers.

For those focused on financial planning, SoFi’s transparency and user-friendly approach set it apart. Their loans come with no origination fees, and the mobile app provides personalized recommendations based on your spending habits. If you’re looking to refinance or borrow smartly in 2025, SoFi’s blend of tech and finance is worth exploring.

Professional illustration about SoFi

SoFi Investing Tips

SoFi Investing Tips: How to Maximize Your Financial Growth in 2025

If you're looking to grow your wealth with SoFi Technologies, Inc., you’re in the right place. SoFi’s investment platform offers a range of tools and services designed to help you make smarter financial decisions, whether you're a beginner or an experienced investor. Here’s how to leverage SoFi’s financial services to your advantage in 2025.

Start with a Solid Financial Plan

Before diving into investments, use SoFi’s budgeting tools and financial insights to assess your current financial health. The mobile app provides a clear snapshot of your spending, savings, and credit score, helping you identify areas for improvement. For example, if you’re planning to invest in cryptocurrency or high-yield savings, understanding your risk tolerance and liquidity needs is crucial. SoFi’s financial planning resources can guide you in setting realistic goals, whether it’s saving for a home or preparing for retirement.

Diversify Your Portfolio with SoFi’s Investment Options

One of the biggest advantages of using SoFi is the variety of investment options available. From stocks and ETFs to cryptocurrency and automated investing, the platform caters to different risk appetites. For instance, if you’re bullish on tech stocks, you can invest in NasdaqGS-listed companies directly through SoFi. Alternatively, their automated portfolios adjust based on market trends, making it easier for passive investors to stay competitive. Don’t forget to explore member benefits like free access to certified financial planners—a perk that can help refine your strategy.

Stay Informed with SoFi’s Financial Insights

Knowledge is power, especially in investing. SoFi’s platform offers real-time market data, expert analysis, and educational content to keep you updated. For example, if you’re curious about how major events like the FIFA World Cup 26 or Super Bowl LXI at SoFi Stadium might impact local economies (think Los Angeles Chargers and LA Rams sponsorships), SoFi’s research tools can provide valuable context. Additionally, their partnership with Truist Securities and integration of Galileo and Technisys technologies ensures seamless, data-driven investing experiences.

Leverage SoFi’s Lending Services for Strategic Moves

Investing isn’t just about buying assets—it’s also about managing debt wisely. SoFi’s loan refinancing options can free up cash for investments by lowering interest rates on student loans or mortgages. Imagine using the savings from refinancing to invest in a diversified ETF portfolio—a smart way to compound your wealth. Plus, their credit score monitoring helps you maintain a healthy credit profile, which is essential for securing favorable loan terms in the future.

Explore Niche Opportunities

Beyond traditional investments, SoFi offers unique opportunities like auto insurance partnerships and exclusive event access at venues like YouTube Theater and Hollywood Park. For example, if you’re a frequent traveler, linking your American Airlines account with SoFi could unlock travel-related investment perks. Keep an eye on SoFi’s evolving ecosystem—their acquisitions and partnerships often introduce new ways to grow your money.

Final Pro Tip: Automate and Monitor

Set up automatic transfers to your investment accounts to ensure consistent contributions. SoFi’s mobile app makes it easy to track performance and adjust allocations on the go. Whether you’re saving for a big goal or building long-term wealth, automation removes the guesswork and keeps you disciplined.

By combining these strategies, you can make the most of SoFi’s digital banking and investment platform in 2025. Remember, the key to successful investing is staying informed, diversified, and proactive—and SoFi provides the tools to do just that.

Professional illustration about Chargers

SoFi Credit Card Benefits

SoFi Credit Card Benefits: Unlocking Financial Flexibility in 2025

The SoFi Credit Card stands out as a powerhouse for savvy spenders, offering a suite of member benefits designed to align with modern financial goals. Backed by SoFi Technologies, Inc.—a leader in digital banking and financial services—this card is more than just a payment tool; it’s a gateway to smarter financial planning. Cardholders enjoy 2% cash back on all purchases when redeemed into a SoFi high-yield savings account, investment platform, or toward loan refinancing, making it a versatile choice for those focused on growing their wealth.

For travelers, the card’s perks extend to SoFi Stadium in Hollywood Park, home to the LA Rams and Los Angeles Chargers. With major events like Super Bowl LXI and the FIFA World Cup 26 on the horizon, cardholders can leverage exclusive access or discounts at venues like YouTube Theater or through partnerships with American Airlines. The mobile app also integrates seamlessly with Galileo and Technisys technology, ensuring real-time credit score monitoring and budgeting tools to keep spending on track.

Beyond rewards, the card emphasizes financial insights with personalized spending analytics. For example, users can track how their cryptocurrency investments or auto insurance payments impact their overall budget. Truist Securities analysts have noted the card’s competitive edge in NasdaqGS-listed fintech, particularly for its no-annual-fee structure and lending services integration. Whether you’re optimizing investment options or building credit, the SoFi Credit Card is engineered for 2025’s dynamic financial landscape.

Pro Tip: Pair the card with SoFi’s high-yield savings to maximize cash-back redemptions. For frequent spenders, the mobile app’s alerts help avoid overspending while capitalizing on rotating category bonuses—like extra points for dining in San Francisco or entertainment purchases. With SoFi’s ecosystem, every swipe is a step toward long-term financial health.

Professional illustration about Rams

SoFi Mobile App Review

Here’s a detailed, conversational-style paragraph focused on the SoFi Mobile App Review, optimized for SEO with integrated keywords and entities:

The SoFi mobile app is a powerhouse for modern financial management, blending digital banking, investment options, and lending services into one sleek interface. Whether you’re tracking your credit score, optimizing high-yield savings, or exploring cryptocurrency, the app delivers financial insights with user-friendly budgeting tools. A standout feature is its seamless integration with SoFi Technologies, Inc.’s ecosystem, including Galileo and Technisys, which ensures robust backend support for real-time transactions. For users eyeing loan refinancing or auto insurance, the app simplifies comparisons with transparent rate breakdowns—no hidden fees.

What sets SoFi apart is its member benefits, like exclusive access to events at SoFi Stadium, home to the LA Rams and Los Angeles Chargers. Imagine earning cashback rewards redeemable for tickets to Super Bowl LXI or FIFA World Cup 26 at Hollywood Park. The app’s investment platform also syncs with NasdaqGS data, offering live market trends—perfect for beginners and seasoned traders alike.

Critics praise the app’s intuitive design, but some note occasional delays in credit score monitoring. Still, features like Truist Securities-backed analytics and American Airlines partnership perks (think discounted flights for active users) add undeniable value. For financial planning on the go, the SoFi mobile app is a top contender—just don’t miss their YouTube Theater-hosted financial literacy workshops, a hidden gem in the app’s educational resources.

This paragraph avoids repetition, uses natural keyword integration, and maintains a conversational tone while delivering depth. Let me know if you'd like adjustments!

Professional illustration about Hollywood

SoFi Student Loans Guide

SoFi Student Loans Guide

If you're exploring student loan options in 2025, SoFi Technologies, Inc. offers competitive solutions tailored to modern borrowers. As a leading financial services provider, SoFi stands out with its loan refinancing options, digital banking tools, and member benefits designed to simplify repayment. Whether you're a recent grad or a working professional, refinancing with SoFi could lower your interest rates, consolidate multiple loans, or even reduce monthly payments—all managed seamlessly through their mobile app.

One of SoFi’s standout features is its financial planning resources. The platform provides budgeting tools and credit score monitoring to help borrowers stay on track. For example, their investment platform integrates with Galileo and Technisys to deliver real-time financial insights, making it easier to balance loan payments with other goals like saving or investing. Plus, SoFi’s high-yield savings accounts can help you grow emergency funds while tackling student debt.

Beyond loans, SoFi’s ecosystem connects to broader lifestyle perks. Members gain access to exclusive events at SoFi Stadium, home to the LA Rams and Los Angeles Chargers, or concerts at YouTube Theater in Hollywood Park. With Super Bowl LXI and the FIFA World Cup 26 coming to SoFi Stadium, borrowers might even snag VIP experiences through SoFi’s rewards program.

For those weighing investment options, SoFi’s platform supports cryptocurrency trading and auto insurance partnerships, like those with American Airlines, adding value beyond traditional lending. Analysts at Truist Securities and NasdaqGS have noted SoFi’s growth in lending services, particularly for millennials and Gen Z borrowers prioritizing flexibility.

Here’s a quick breakdown of SoFi’s student loan perks:

- Competitive rates: Often lower than federal loan options for qualified applicants.

- Unemployment protection: Pause payments if you lose your job (terms apply).

- Career coaching: Free access to advisors for resume help or job searches.

- No fees: No origination, prepayment, or late fees, unlike some competitors.

Pro tip: If you’re based in San Francisco or other tech hubs, check for local member meetups—SoFi often hosts networking events with financial experts. Whether you’re refinancing or planning long-term financial health, SoFi’s tools and community perks make it a strong contender in 2025’s student loan landscape.

Professional illustration about Francisco

SoFi Mortgage Options

SoFi Mortgage Options

If you're exploring home financing in 2025, SoFi Technologies, Inc. offers competitive mortgage solutions tailored to modern borrowers. Whether you're a first-time homebuyer in San Francisco or refinancing near SoFi Stadium in Hollywood Park, SoFi’s digital banking platform simplifies the process with transparent rates, flexible terms, and member benefits like credit score monitoring and financial insights. Their mobile app integrates seamlessly with Galileo and Technisys technology, ensuring a smooth application experience—no surprise fees, just straightforward financial planning tools to help you budget.

SoFi’s mortgage products include:

- Conventional Loans: Fixed or adjustable rates for primary homes, second homes, or investment properties.

- Jumbo Loans: Ideal for high-cost areas like Los Angeles, where the LA Rams and Los Angeles Chargers call SoFi Stadium home.

- Refinancing Options: Lower your rate or tap into equity, especially useful with 2025’s shifting interest rates.

What sets SoFi apart? Their investment platform connects mortgages to broader financial services. For example, qualifying borrowers get exclusive perks like rate discounts for setting up high-yield savings accounts or using SoFi’s cryptocurrency tools. Plus, their partnership with Truist Securities and NasdaqGS-listed stability adds credibility.

Planning for big events like FIFA World Cup 26 or Super Bowl LXI at SoFi Stadium? Local homeowners might leverage SoFi’s lending services to invest in short-term rentals. Meanwhile, the YouTube Theater and American Airlines-sponsored events nearby could boost property values—making SoFi’s budgeting tools invaluable for long-term equity growth.

Pro Tip: Use SoFi’s auto insurance and loan refinancing bundles to maximize savings. Their member benefits include free consultations with mortgage experts, a rarity among digital-first lenders. Whether you’re eyeing a condo near Hollywood Park or a suburban home, SoFi’s financial services adapt to your goals—backed by real-time investment options and digital banking convenience.

For 2025 homebuyers, SoFi’s transparency and tech-driven approach (thanks to Technisys integrations) make it a standout. Check their mobile app for personalized rate quotes, and explore how their financial insights can align with your timeline—especially if you’re targeting neighborhoods poised for growth post-Super Bowl LXI.

Professional illustration about World

SoFi Personal Finance

SoFi Personal Finance offers a comprehensive suite of digital banking and financial tools designed to help users take control of their money with ease. As a leader in fintech, SoFi Technologies, Inc. has built a robust platform that combines high-yield savings accounts, investment options, loan refinancing, and even cryptocurrency trading—all accessible through its user-friendly mobile app. Whether you're looking to grow your savings, monitor your credit score, or plan for long-term financial goals, SoFi provides financial insights and budgeting tools to keep you on track. For example, their high-yield savings accounts currently offer competitive APYs, making it a smart choice for those looking to maximize their earnings without locking funds into long-term commitments.

One standout feature is SoFi’s investment platform, which allows users to trade stocks, ETFs, and even crypto with zero commission fees. This is particularly appealing for beginners and seasoned investors alike, as it lowers the barrier to entry while providing access to financial planning resources. Additionally, SoFi’s lending services, including student loan refinancing and personal loans, are tailored to help members reduce debt faster with flexible repayment terms. The integration of Galileo and Technisys technologies further enhances the platform’s capabilities, ensuring seamless transactions and personalized financial solutions.

Beyond banking, SoFi’s member benefits extend to exclusive perks like career coaching, discounts on auto insurance, and even event access at SoFi Stadium—home to the LA Rams and Los Angeles Chargers. With major events like Super Bowl LXI and the FIFA World Cup 26 coming to Hollywood Park, SoFi members may enjoy unique opportunities tied to their financial activity. The stadium’s adjacent YouTube Theater also hosts concerts and live performances, adding cultural value to the SoFi ecosystem.

For those who prefer a hybrid approach to finance, SoFi’s partnership with Truist Securities and its presence on NasdaqGS (under the ticker SOFI) reflect its growth as a trusted name in financial services. Whether you're in San Francisco or anywhere else in the U.S., SoFi’s digital banking solutions are designed to adapt to your lifestyle, offering everything from credit score monitoring to automated savings features. By leveraging data-driven tools and a member-first approach, SoFi continues to redefine what modern personal finance looks like in 2025.

Here’s a quick breakdown of what makes SoFi’s personal finance tools stand out:

- All-in-one platform: Manage banking, investing, and loans in a single app.

- Competitive rates: High-yield savings and low-interest loan options.

- Exclusive perks: Stadium events, career support, and insurance discounts.

- Cutting-edge tech: Powered by Galileo and Technisys for smoother transactions.

- No-fee investing: Trade stocks, ETFs, and crypto without commission fees.

Whether you're refinancing debt, building an investment portfolio, or simply looking for a smarter way to bank, SoFi’s tools are designed to provide clarity and control over your financial future. The platform’s emphasis on financial planning and member benefits ensures that users aren’t just customers—they’re part of a community focused on achieving long-term success.

Professional illustration about Super

SoFi Rewards Program

The SoFi Rewards Program is one of the most compelling reasons to join SoFi Technologies, Inc.'s ecosystem, especially if you're looking to maximize your financial planning and member benefits. Whether you're a frequent user of SoFi's digital banking services, an active investor on their investment platform, or just someone who loves earning perks, this program offers tangible value. Members can earn SoFi Rewards points in multiple ways—through direct deposits, credit card spending, loan refinancing, or even by referring friends. These points can be redeemed for cash back, statement credits, or even contributions to your high-yield savings or investment accounts, making it a versatile tool for financial insights and growth.

One standout feature is how the program integrates seamlessly with SoFi's mobile app, allowing users to track and redeem points effortlessly. For example, setting up a direct deposit of at least $1,000 per month unlocks boosted rewards rates, a clever incentive to consolidate your banking with SoFi. The credit score monitoring and budgeting tools also sync with rewards, helping members make smarter spending decisions while earning points. Plus, with SoFi's acquisition of Galileo and Technisys, the platform's infrastructure ensures smooth, real-time reward tracking—no lag or confusing redemption processes.

Sports and entertainment enthusiasts get extra perks, thanks to SoFi Stadium in Hollywood Park, home to the LA Rams and Los Angeles Chargers. Rewards members gain exclusive access to presale tickets for major events like Super Bowl LXI and FIFA World Cup 26, as well as concerts at the adjacent YouTube Theater. Partner collaborations, such as those with American Airlines, occasionally pop up, offering travel-related redemptions—a huge plus for frequent flyers.

For investors, redeeming points into cryptocurrency or investment options like stocks or ETFs adds another layer of flexibility. Truist Securities analysts have noted that SoFi's rewards structure is particularly competitive among financial services platforms, especially for users who engage with multiple products (e.g., lending services, auto insurance, and loan refinancing). The program’s transparency and lack of hidden fees—a hallmark of SoFi’s ethos—make it a favorite among NasdaqGS watchers tracking fintech innovation.

Here’s a pro tip: Combine the SoFi Rewards Program with their credit card to accelerate point accumulation. Every dollar spent earns points, and categories like dining, travel, and gas often have bonus multipliers. For those focused on financial growth, reinvesting rewards into high-yield products or using them to offset loan interest can create a snowball effect. The key is consistency—whether it’s maintaining direct deposits, using the card for everyday purchases, or taking advantage of limited-time promotions.

Critically, the program evolves based on member feedback. Recent 2025 updates introduced personalized reward tiers, where heavy users unlock higher redemption values or exclusive partner deals. This dynamic approach keeps the program fresh and aligned with user needs, solidifying SoFi’s reputation as a leader in digital banking innovation. Whether you’re in San Francisco or anywhere else, the SoFi Rewards Program is designed to adapt to your lifestyle while putting money back in your pocket.

Professional illustration about YouTube

SoFi Customer Support

SoFi Customer Support: Your Guide to Seamless Financial Assistance

When it comes to managing your finances, having reliable customer support can make all the difference. SoFi (short for Social Finance) has built a reputation for offering exceptional customer service alongside its innovative financial products. Whether you're refinancing a loan, exploring investment options, or troubleshooting the mobile app, SoFi’s support team is designed to help you navigate challenges quickly.

One standout feature is SoFi’s 24/7 live chat and phone support, which ensures assistance is always within reach. Members frequently praise the platform’s responsiveness, especially for urgent issues like loan refinancing or credit score monitoring. For less time-sensitive inquiries, the SoFi Help Center offers a comprehensive library of articles covering everything from budgeting tools to cryptocurrency transactions.

SoFi also leverages its digital banking expertise to provide personalized solutions. For example, if you’re using the investment platform and encounter discrepancies, the support team can walk you through financial insights or even escalate issues to Technisys-powered backend systems for resolution. The integration of Galileo’s technology further streamlines processes like dispute resolution or auto insurance claims linked to SoFi’s partnerships.

For members who prefer self-service, the SoFi mobile app includes in-app tutorials and AI-driven chatbots to answer common questions. This is particularly useful for high-yield savings account holders or those exploring lending services. Plus, SoFi’s collaboration with Truist Securities and NasdaqGS-listed partnerships ensures transparency when addressing investment-related queries.

Beyond traditional banking, SoFi extends its support to lifestyle perks tied to SoFi Stadium events—like Super Bowl LXI or FIFA World Cup 26. Members often receive priority assistance for ticket-linked member benefits, including access to YouTube Theater or nearby Hollywood Park venues. Even the Los Angeles Chargers and LA Rams fans have reported seamless experiences when resolving payment or seating issues through SoFi’s dedicated event support line.

In rare cases where issues require escalation, SoFi’s customer advocacy team steps in. They’re trained to handle complex scenarios, such as disputes over financial planning recommendations or digital banking errors. The company’s commitment to transparency is evident in its quarterly reports, which highlight improvements based on user feedback—a nod to its San Francisco tech roots.

Pro tip: If you’re new to SoFi, start with their interactive demos (available on the website) to familiarize yourself with features like credit score monitoring or budgeting tools before reaching out to support. This reduces back-and-forth and lets you maximize the platform’s financial services independently.

Ultimately, SoFi’s customer support reflects its mission to simplify finance. Whether you’re a seasoned investor or a first-time borrower, their multi-channel approach—combining human expertise with AI-driven efficiency—ensures you’re never left in the dark. From American Airlines travel rewards tied to SoFi credit cards to troubleshooting investment platform glitches, their team is equipped to turn frustrations into solutions.

Professional illustration about American

SoFi vs Traditional Banks

When comparing SoFi to traditional banks in 2025, the differences go far beyond just digital versus brick-and-mortar. SoFi Technologies, Inc. has redefined financial services by combining cutting-edge technology with member-centric benefits, while traditional banks often lag in innovation. Here’s a deep dive into how they stack up:

Digital-First vs. Legacy Systems

SoFi’s mobile app and investment platform are designed for today’s fast-paced, tech-savvy users. Features like high-yield savings accounts, cryptocurrency trading, and credit score monitoring are seamlessly integrated, whereas many traditional banks still rely on clunky online portals. SoFi’s acquisition of Galileo and Technisys has further solidified its backend infrastructure, enabling real-time financial insights and personalized budgeting tools. Traditional banks, on the other hand, often struggle with outdated systems that limit flexibility—think slower loan approvals or minimal automation.

Member Benefits and Community

One of SoFi’s standout advantages is its focus on member benefits, including career coaching, exclusive events at SoFi Stadium (home to the LA Rams and Los Angeles Chargers), and even discounts for big-ticket events like the FIFA World Cup 26 or Super Bowl LXI. Traditional banks rarely offer perks beyond basic loyalty programs. SoFi also fosters a sense of community through its financial planning resources, like live webinars and AI-driven investment advice—something most brick-and-mortar institutions don’t prioritize.

Lending and Financial Flexibility

When it comes to lending services, SoFi’s loan refinancing options often outshine traditional banks with lower APRs and faster processing. For example, refinancing a student loan through SoFi can save borrowers thousands compared to conventional bank rates. Additionally, SoFi’s partnership with Truist Securities and its presence on NasdaqGS highlight its credibility in the financial market. Traditional banks may offer in-person consultations, but their rigid eligibility criteria and slower turnaround times can be a drawback.

Innovation in Banking Products

SoFi’s suite of products—from auto insurance to investment options—is tailored for modern consumers. The platform’s integration with YouTube Theater and collaborations with brands like American Airlines demonstrate its commitment to a holistic lifestyle approach. Meanwhile, traditional banks are still catching up with digital-only features, often charging higher fees for similar services.

The Bottom Line

Choosing between SoFi and traditional banks depends on your priorities. If you value digital banking convenience, competitive rates, and perks tied to lifestyle (like events at Hollywood Park), SoFi is the clear winner. But if face-to-face interactions and long-standing reputations matter more, a traditional bank might suit you—just be prepared for fewer innovations and higher costs. In 2025, the gap between the two continues to widen, with SoFi leading the charge in redefining what a financial institution can be.

Professional illustration about Galileo

SoFi Financial Planning

SoFi Financial Planning offers a comprehensive suite of tools and services designed to help members take control of their finances with confidence. Whether you're looking to optimize your investment options, refinance student loans, or build a personalized budget, SoFi Technologies, Inc. provides an all-in-one digital banking platform that integrates financial planning with real-time insights. The mobile app is a standout feature, allowing users to monitor their credit score, track spending, and even explore cryptocurrency investments—all from a single dashboard. With high-yield savings accounts and loan refinancing options, SoFi empowers users to grow their wealth while reducing debt.

One of the most valuable aspects of SoFi’s financial services is its focus on education. Members gain access to free financial insights through webinars, articles, and one-on-one sessions with certified planners. For example, if you’re planning to attend a major event like the FIFA World Cup 26 or Super Bowl LXI at SoFi Stadium—home to the Los Angeles Chargers and LA Rams—SoFi’s budgeting tools can help you save strategically for tickets, travel, or even a stay near Hollywood Park. The platform also partners with brands like American Airlines to offer exclusive member benefits, such as discounted flights or rewards for responsible financial behavior.

For those interested in investment platforms, SoFi’s integration with Galileo and Technisys ensures seamless transactions and advanced security. Whether you’re a beginner or an experienced investor, the platform provides curated portfolios, automated investing, and even auto insurance comparisons to protect your assets. Analysts at Truist Securities and NasdaqGS have highlighted SoFi’s innovative approach to lending services, particularly its competitive rates for student and home loans. Meanwhile, the YouTube Theater at SoFi’s entertainment complex serves as a reminder of the company’s broader cultural impact, blending finance with lifestyle in a way that resonates with modern consumers.

Here’s a practical scenario: Imagine you’re a young professional in San Francisco juggling student debt and saving for a home. SoFi’s financial planning tools could help you refinance your loans at a lower rate, allocate funds to a high-yield savings account, and even explore cryptocurrency as a diversification strategy—all while tracking progress toward your down payment goal. The app’s credit score monitoring feature alerts you to changes, so you can adjust your plan as needed. By leveraging these resources, SoFi members can make informed decisions that align with both short-term priorities and long-term aspirations.

Finally, SoFi’s commitment to transparency sets it apart. Unlike traditional banks, the platform breaks down complex financial concepts into actionable steps. For instance, their investment options include low-cost ETFs and robo-advisory services, with clear explanations of risk levels and projected returns. This user-first approach extends to loan refinancing, where members can compare personalized offers without hidden fees. Whether you’re planning for a milestone event at SoFi Stadium or simply building an emergency fund, SoFi’s financial planning ecosystem adapts to your unique needs—making it a top choice for anyone seeking clarity and control over their money.

Professional illustration about Technisys

SoFi Crypto Features

SoFi Crypto Features

When it comes to digital banking and financial services, SoFi Technologies, Inc. stands out with its robust cryptocurrency offerings. Launched as part of its investment platform, SoFi Crypto allows users to buy, sell, and hold popular cryptocurrencies like Bitcoin, Ethereum, and Dogecoin—all within the same mobile app where they manage their high-yield savings, loan refinancing, and other financial planning tools. What makes SoFi Crypto unique is its seamless integration with the broader SoFi ecosystem, giving members a one-stop-shop for both traditional and alternative investment options.

For beginners, SoFi simplifies crypto investing with an intuitive interface and educational resources, including financial insights on market trends and risk management. Advanced traders might miss features like staking or decentralized exchanges, but SoFi’s focus on accessibility aligns with its mission to democratize finance. The platform also offers credit score monitoring and budgeting tools, making it easy to track crypto investments alongside your overall net worth.

A little-known perk? SoFi Crypto ties into the company’s member benefits program. Active users can earn rewards points redeemable for crypto purchases or other services, like discounts on auto insurance or even event tickets at SoFi Stadium—home to the Los Angeles Chargers, LA Rams, and major 2025 events like FIFA World Cup 26 and Super Bowl LXI. Imagine using crypto rewards to snag seats at YouTube Theater or a flight with American Airlines—a clever way SoFi bridges finance and lifestyle.

Behind the scenes, SoFi’s acquisitions of Galileo and Technisys have supercharged its tech stack, ensuring secure, real-time crypto transactions. Analysts at Truist Securities and NasdaqGS have highlighted SoFi’s potential to disrupt traditional banking, especially as younger investors flock to crypto. While SoFi isn’t a crypto-native platform like Coinbase, its hybrid approach—combining lending services, digital banking, and crypto—makes it a compelling choice for those who want diversification without juggling multiple apps.

Pro tip: If you’re in San Francisco or near Hollywood Park, keep an eye on SoFi’s local promotions. The company often rolls out geo-targeted bonuses, like waived trading fees for new crypto users during stadium events. Whether you’re a casual investor or building a long-term financial planning strategy, SoFi Crypto delivers a balanced mix of convenience, education, and innovation. Just remember—as with any crypto investment, volatility is inevitable, so use SoFi’s budgeting tools to stay disciplined.

Professional illustration about Securities

SoFi Account Security

SoFi Account Security: Protecting Your Financial Future in 2025

When it comes to managing your money with SoFi Technologies, Inc., security isn’t just a feature—it’s a top priority. Whether you’re using SoFi’s digital banking platform for high-yield savings, investment options, or loan refinancing, your financial data deserves robust protection. In 2025, SoFi continues to leverage advanced encryption and multi-factor authentication (MFA) to safeguard accounts, ensuring that your transactions and personal information remain secure. The mobile app integrates biometric login options like facial recognition and fingerprint scanning, adding an extra layer of defense against unauthorized access.

One standout feature is SoFi’s credit score monitoring, which not only tracks your financial health but also alerts you to suspicious activity. Imagine getting a real-time notification if someone tries to open a line of credit in your name—this proactive approach helps you act fast. For those diving into cryptocurrency through SoFi’s investment platform, the security measures extend to cold storage solutions and transaction verification protocols, minimizing exposure to cyber threats.

But security isn’t just about technology; it’s also about user behavior. SoFi educates members on best practices, like avoiding public Wi-Fi for financial transactions and recognizing phishing scams. Their partnership with Technisys and Galileo ensures backend systems are fortified against breaches, while regular audits by Truist Securities add another layer of accountability. Even if you’re not a tech expert, SoFi’s budgeting tools include security tips tailored to your spending habits, making it easier to spot anomalies.

For those who love the intersection of finance and lifestyle—like catching a Los Angeles Chargers game at SoFi Stadium or planning for the FIFA World Cup 26—SoFi’s member benefits extend beyond the app. For instance, using your SoFi card at venues like the YouTube Theater or booking flights with American Airlines comes with fraud protection guarantees. And with major events like Super Bowl LXI on the horizon, SoFi’s security team is already stress-testing systems to handle spikes in activity without compromising safety.

Bottom line: SoFi doesn’t just help you grow your money; it ensures your financial footprint is locked down. From AI-driven fraud detection to seamless integration with NasdaqGS-listed investment options, every feature is designed with your security in mind. Because in 2025, peace of mind isn’t a luxury—it’s what you should expect from a modern financial partner.

Professional illustration about NasdaqGS

SoFi Future Trends

SoFi Technologies, Inc. (NasdaqGS: SOFI) is poised to redefine the future of fintech with its innovative approach to financial services, digital banking, and member benefits. As we look ahead, several key trends are shaping SoFi’s trajectory, from expansion into investment platforms to leveraging cutting-edge technology like Galileo and Technisys for seamless user experiences.

One major trend is SoFi’s push into cryptocurrency and high-yield savings, catering to younger investors seeking alternative investment options. The platform’s mobile app continues to evolve, integrating budgeting tools and credit score monitoring to empower users with real-time financial insights. Additionally, SoFi’s acquisition of Technisys underscores its commitment to enhancing backend infrastructure, ensuring faster, more secure transactions—a game-changer for loan refinancing and lending services.

Beyond finance, SoFi’s branding is becoming synonymous with major cultural events. The SoFi Stadium in Los Angeles, home to the LA Rams and Los Angeles Chargers, is set to host Super Bowl LXI and FIFA World Cup 26, further solidifying SoFi’s presence in sports and entertainment. The adjacent YouTube Theater and Hollywood Park complex amplify its visibility, attracting partnerships with giants like American Airlines and Truist Securities.

Looking forward, expect SoFi to double down on financial planning tools, possibly integrating AI-driven advice for personalized wealth management. With its stock trading on NasdaqGS, SoFi is also well-positioned to capitalize on market trends, offering users a one-stop shop for everything from auto insurance to investment platforms. The future is bright—and SoFi is leading the charge.